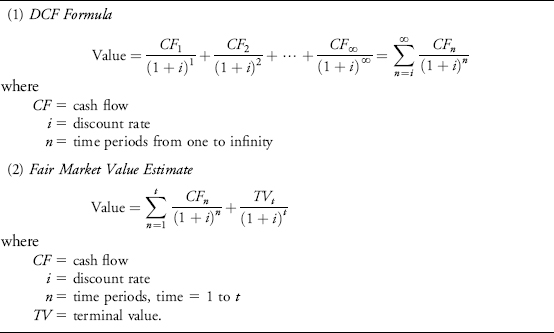

THE DCF FORMULA

The formula for the DCF approach is shown in equation (1) of Figure 5.1. The cash flow (CF) for each time period (n) is reduced to its present value using the compound-interest term [(1+i)n]. The value of the company equals the sum of the present values for all periods, one to infinity. With a lot of work, it is usually possible to come up with an acceptable estimate of next year’s cash flow. Each additional year becomes more difficult to estimate with an acceptable degree of accuracy.

In the real world it is very hard to work with time periods that extend to infinity and still maintain any semblance of rationality. Therefore, when the DCF method is used to value a business, the distant future is typically combined into one value representing the estimated sale price (terminal value) at some relatively close point in time. Thus, if equation (1) were to be ended at time period t instead of continuing to infinity, the formula would be modified as shown in equation (2). Typically, we estimate 5 or 10 years of individual cash flows (CF1,CF2,CF3,CF4,. . .,CFt) and then estimate what the company could be sold for at the end of the period (TVt). All of these estimates are then discounted to their present values at the valuation date, using standard compound-interest formulas, and the present values are added together to ...

Get Valuation Techniques: Discounted Cash Flow, Earnings Quality, Measures of Value Added, and Real Options now with the O’Reilly learning platform.

O’Reilly members experience books, live events, courses curated by job role, and more from O’Reilly and nearly 200 top publishers.