APPENDIX E

The Impact of Discounting on an Asset Swap Spread

In this appendix we show that the impact of discounting on an asset swap spread is limited, as discussed in Section 6.1.2.

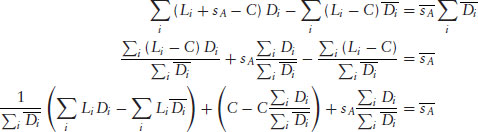

Let us for simplicity assume (a fairly weak assumption since it would be a common situation) that the fixed and floating legs of the swap have the same frequency. We are going to discount an asset swap with spread sA with discount factors Di and then with discount factors ![]() and see what the difference, if at all, is with the new asset swap spread

and see what the difference, if at all, is with the new asset swap spread ![]() . In practice we want to solve

. In practice we want to solve

for ![]() , since both sides need to be equal to the bond price because the change in discounting was not applied to the bond.

, since both sides need to be equal to the bond price because the change in discounting was not applied to the bond.

Grouping the terms in E.1 we obtain

Let us imagine that ![]() is slightly greater than

is slightly greater than ![]() , then the term

, then the term

will ...

Get Treasury Finance and Development Banking: A Guide to Credit, Debt, and Risk, + Website now with the O’Reilly learning platform.

O’Reilly members experience books, live events, courses curated by job role, and more from O’Reilly and nearly 200 top publishers.