APPENDIX D

The Relation between Macaulay and Modified Durations

We are going to show, as stated in Section 5.2.3, how the relationship between Macaulay and modified durations are dependent on the type of compounding we choose.

Let us first consider the case of continuous compounding. The modified duration is defined (Equation 5.7) as

![]()

If we calculate the bond value Bt, assuming continuous compounding, we have

![]()

where CT, here and throughout this appendix, includes the principal payment. Taking the derivative of the above and dividing by the bond value we obtain

![]()

which is the definition of Macaulay duration given by Equation 5.8.

Let us now consider the situation in which the yield is not continuously compounded, that is,

![]()

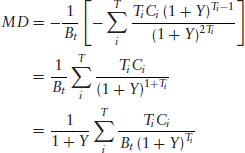

If we take the derivative and divide by the bond value we obtain

(D.1)

from which it follows that for noncontinuously compounded yields the relationship between Macaulay duration McD and modified duration is

as given by Equation 5.9.

Get Treasury Finance and Development Banking: A Guide to Credit, Debt, and Risk, + Website now with the O’Reilly learning platform.

O’Reilly members experience books, live events, courses curated by job role, and more from O’Reilly and nearly 200 top publishers.