Chapter 6

Retracement Analysis

Using Retracement Analysis to Continue Your Move

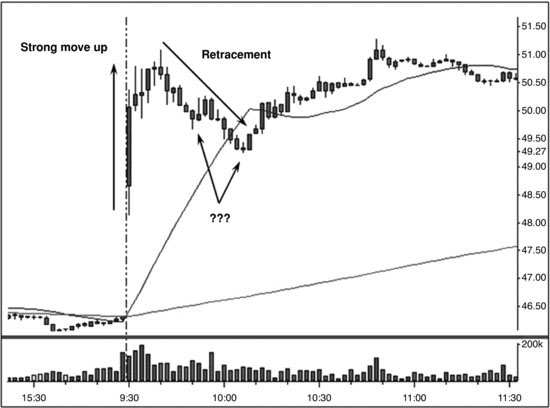

When we discuss retracements in technical analysis, we are talking about how much a strong move up or down gives back on the countermove. We are talking about the pullback, the countermove, or (and you may have heard the term) Fibonacci. We may be looking at various things such as the steepness of the pullback, the angle of retracement, the percentage of the decline or rally, or we may talk about the precision or the sloppiness of the pullback. But no matter the analysis used, the goal is the same: A stock has moved a certain amount in one direction, and we want to see what happens next.

THE CONCEPT OF RETRACEMENTS

Let's say a stock has moved to the upside. If the bulls are in control, and if that move was serious, there should be a limit to how much the stock gives back of the move that just happened. This is the bottom line to retracement analysis and it's that simple.

Like anything else in technical analysis, this is one concept or tool to use in conjunction with all the other technical features we are discussing in this book. It is very rare that any trade would be played due completely to one technical component. It is not so rare, however, that we may negate a trade due to one technical component being way out of ...