POSITION SIZING: MY STORY

When I first started trading, I did not worry about position size because I did not have enough money to be concerned. I allocated $2,000 to each position and had few stocks in my portfolio.

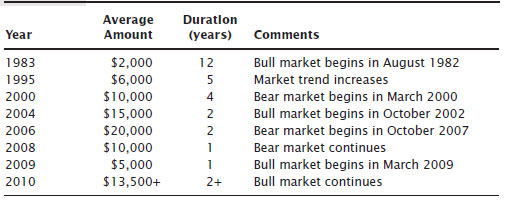

Table 2.1 shows the average amount of each trade, based on actual trades. Over the years, I added to positions in the same stock, so a $2,000 per trade investment sometimes meant that I boosted the value of the holding to significantly more than just $2,000.

Table 2.1 Position Size Over Time

For 12 years, I traded stocks with a value of about $2,000 per trade, riding the bull market that began in 1982. I did own stocks before 1983, but they were from a stock purchase program at my employer, so I exclude them.

In 1995, I tripled the amount of money available for each trade to $6,000. If you look at the chart of the S&P 500 index on the log scale, 1995 is when the market started trending at a steeper slope. At the time, I had no idea what was coming, but increasing the bet size was a good call.

The $6k per trade lasted five years until I bumped it up to $10,000 in 2000. That was right as the bear market began (March 2000). Surprisingly, I did not cut the trade size to reduce risk.

Four years later, I increased the trade size to $15,000 and then $20,000 after that. Placing trades at a minimum of $20,000 each made me nervous and with good reason. I write minimum because ...

Get Trading Basics: Evolution of a Trader now with the O’Reilly learning platform.

O’Reilly members experience books, live events, courses curated by job role, and more from O’Reilly and nearly 200 top publishers.