5.8. IMPROPER OR "DO NOT BUY" POCKET PIVOT POINTS

Just as there are "proper" pocket pivot buy points, there are also "improper" pocket pivot buy points. There are probably as many reasons or criteria to not buy a pocket pivot point as there are reasons or criteria to not buy a standard base breakout. Here we cover some of the basic flaws that we have observed in pocket pivot points that fail. Given that the pocket pivot point is a relatively new discovery, we anticipate that this discussion will prove to be incomplete, as over time many more such flaws will likely be catalogued as our research into the topic continues.

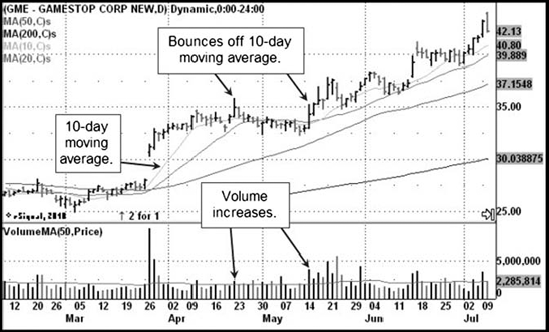

Figure 5.30. GameStop Corp. (GME) daily chart, April–May 2007. Two pocket pivots in the pattern, but only one is "proper."Chart courtesy of eSignal, Copyright 2010

Something to watch out for are pocket pivots that occur when a stock takes a quick dip to the downside and then makes a straight "V" back up to new highs, such as what we see in GameStop Corp. (GME), shown in Figure 5.30. Notice how the pocket pivot on April 23, 2007, moves straight up to new highs after gapping down to a point just above the 20-day moving average two days earlier. This is a little "straight-down-and-straight-up" V-shaped type of move that is suspect, particularly after the stock has already been trending higher over several weeks as GME was doing following its big gap-up breakout in ...

Get Trade Like an O'Neil Disciple: How We Made 18,000% in the Stock Market now with the O’Reilly learning platform.

O’Reilly members experience books, live events, courses curated by job role, and more from O’Reilly and nearly 200 top publishers.