5.7. CONTINUATION POCKET PIVOTS: USING THE 10-DAY MOVING AVERAGE

Once stocks have broken out of a base and are in an uptrend, heading higher in price, finding low-risk points at which to add to one's position in a strongly-acting stock is not always so easy. Waiting for a pullback to a prior standard base breakout pivot point or the 50-day/10-week moving averages is always possible, but having the ability to confidently pinpoint actionable buy points using pocket pivots within an uptrend is a highly useful, additional arrow in our quiver. In general, we focus on the 10-day moving average as our buy guide when determining "continuation" pocket pivot buy points within a stock's uptrend. As always, we maintain a volume requirement that the pocket pivot off the 10-day moving average come on volume that is greater than any down-volume day in the pattern over the prior 10 days.

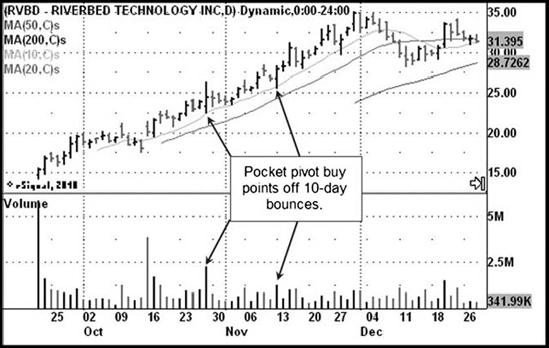

Figure 5.26. Riverbed Technology, Inc. (RVBD) daily chart, October–November 2006. Pocket pivots forming along the 10-day moving average are buyable.: Chart courtesy of eSignal, Copyright 2010

Riverbed Technology (RVBD) offers a good example of a stock "obeying" or "respecting" its 10-day moving average as it trends higher (Figure 5.26). Two pocket pivot buy points occur in the uptrend as it bounces up off the 10-day moving average on October 27 and November 13, 2006. Notice that once RVBD stops "respecting" ...

Get Trade Like an O'Neil Disciple: How We Made 18,000% in the Stock Market now with the O’Reilly learning platform.

O’Reilly members experience books, live events, courses curated by job role, and more from O’Reilly and nearly 200 top publishers.