Chapter 2. THE GOVERNMENT DECLARES WAR ON THE FINANCIAL CRISIS

On November 3, 2010, the Federal Reserve, under Chairman Ben Bernanke, announced a new round of what they called quantitative easing.

The terminology fooled some people some of the time. But most knew what it really was—rolling the printing presses to try to pump up the economy with more cheap paper money. And ironically, it was the Fed's second attempt to do so.

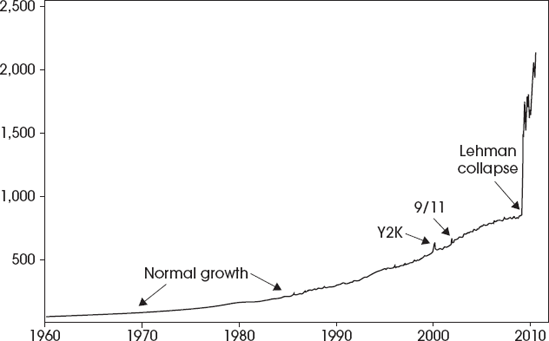

The first attempt, launched soon after Lehman Brothers collapsed in 2008, had been even bigger: From September 10, 2008, through March 10, 2010, Fed Chairman Ben Bernanke increased the nation's monetary base (cash and reserves in the banking system) from $850 billion to $2.1 trillion—an astounding increase of 2.5 times in just 18 months. It was, by far, the greatest monetary expansion in U.S. history.

Figure 2.1 illustrates the sheer enormity of the Fed's actions.

Figure 2.1. U.S. Federal Reserve Runs the Money Printing Presses (monetary base, in billions of dollars)For 40 years, from 1960 through the year 1999, the nation's monetary base (cash and reserves in the banking system) increased steadily and without sudden changes in the pace of growth. In more recent times, however, the Fed expanded the reserves sharply when it felt a crisis was at hand—first in preparation for the feared Y2K computer problems in the banking system and then again in response to the 9/11 ...

Get The Ultimate Money Guide for Bubbles, Busts, Recession, and Depression now with the O’Reilly learning platform.

O’Reilly members experience books, live events, courses curated by job role, and more from O’Reilly and nearly 200 top publishers.