12

Inflation

The stagflation of the 1970s and early 1980s produced a major change in economic theory. Whereas it had previously been assumed that inflation would fall if there were spare capacity in the economy, it is now agreed that this will not occur if expectations of inflation are rising. In these conditions we can have that extremely unpleasant combination of a weak economy and increasing inflation, which is known as stagflation. It has also become generally agreed among economists that in order to halt rising inflationary expectations a shock in the form of a sharp rise in interest rates is needed. As today we have high debt levels and asset prices, I fear that a sharp rise in interest rates would precipitate another financial crisis.

Current views on inflation cover a wide range. To some it is seen as the inevitable result of today's huge fiscal deficits and massive national debt ratios, to others as a solution to the overhang of excessive debt and to others and me as a serious threat.

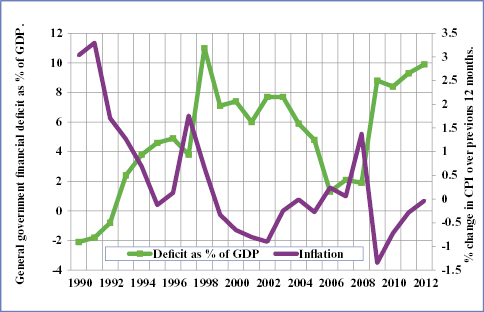

History does not support the claims that inflation is inevitable when deficits and national debts are high, as both Japan's and the US's experience show. For example, Chart 100 shows that Japan has had rising deficits and falling inflation over the past 20 years.

Chart 100. Japan: Falling Inflation & Rising Deficits.Sources: OECD Economic Outlook Vols 78 & 92.

Over the past 100 years there ...

Get The Road to Recovery: How and Why Economic Policy Must Change now with the O’Reilly learning platform.

O’Reilly members experience books, live events, courses curated by job role, and more from O’Reilly and nearly 200 top publishers.