Appendix C

A Simple and Powerful Model Suggests the S&P 500 Is Greatly Underpriced1

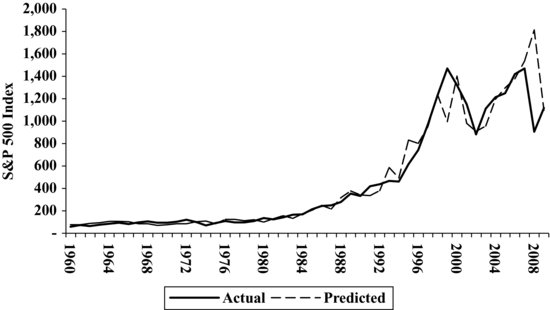

The Risk Premium Factor (RPF) Model can help understand the S&P 500's valuation to identify bubbles and opportunities. It is built on a simple constant growth equation where: P = E/(C − G) and explains S&P Index levels with good accuracy for 1960 to the present using only the risk-free rate, S&P 500 operating earnings, and some simplifying assumptions. Figure C.1 shows this relationship for the past 50 years.

Figure C.1 S&P Historical Average (Actual vs. Predicted), Y/E Data 1960 to 2009

This is based on a very simple model that can enhance understanding for investors by demystifying the factors that drive valuation.

The model shows that two factors drive the market:

1. Earnings

2. Interest rates, which drive cost of capital and embody inflation

And for individual companies, a third factor: Growth.

Understanding that these are the most important factors can help cut through much of the analytical noise to help investors focus on fundamentals.

This remarkably simple model has been useful in identifying the causes of past bubbles, and it continued to work through the recent financial crisis. More details follow below or read the full paper in the Journal of Applied Corporate Finance (http://papers.ssrn.com/sol3/papers.cfm?abstract_id=1663812).

RISK PREMIUM FACTOR VALUATION MODEL

The constant ...