D. Kite Spread

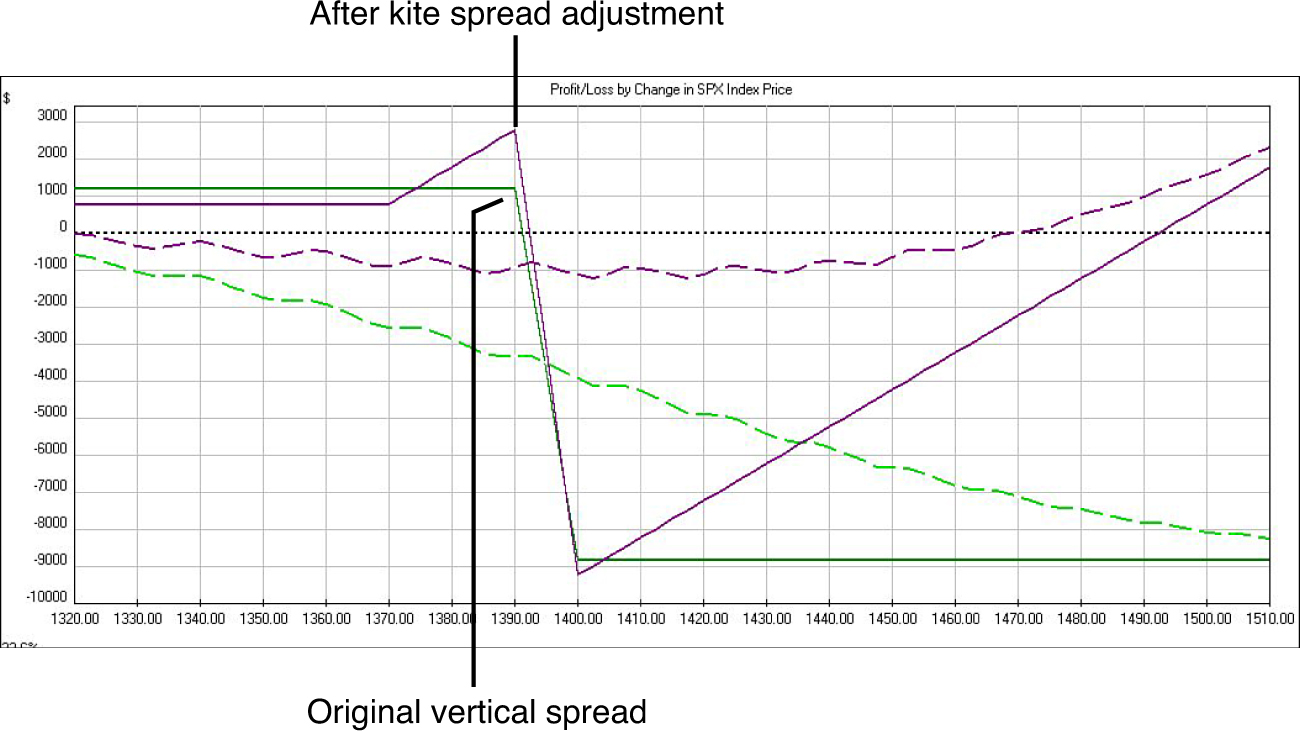

A kite spread involves the buying of a long option below where the short spread is currently placed and then selling more of the original spreads (now at a higher credit) against the long position in an attempt to pay for much of the cost of the long option. Generally, the trader’s goal should be to pay for at least half of the long option in order to reduce cost. It has similar characteristics to a ratio spread, but has less vega and explosive gamma. Figure D.1 shows call credit spread and overlays the kite spread adjustment (the one that has a point like a kite at the 1390 price).

Figure D.1 Risk profile of the vertical call credit ...

Get The Option Trader’s Hedge Fund: A Business Framework for Trading Equity and Index Options now with the O’Reilly learning platform.

O’Reilly members experience books, live events, courses curated by job role, and more from O’Reilly and nearly 200 top publishers.