APPENDIX I

Covered Calls—Covering What?

Covered calls! Like stop losses, the name itself is somehow comforting. But don’t be fooled.

A covered call combines a long stock position and a written call. The idea is you could can gain instant income (from the premium for writing the option), but risk is limited from the option. Ask someone who is fond of covered calls why they like them, and they usually say something like they’re “safe” or “a safe way to get income.” And who wouldn’t want something like that? But is it true?

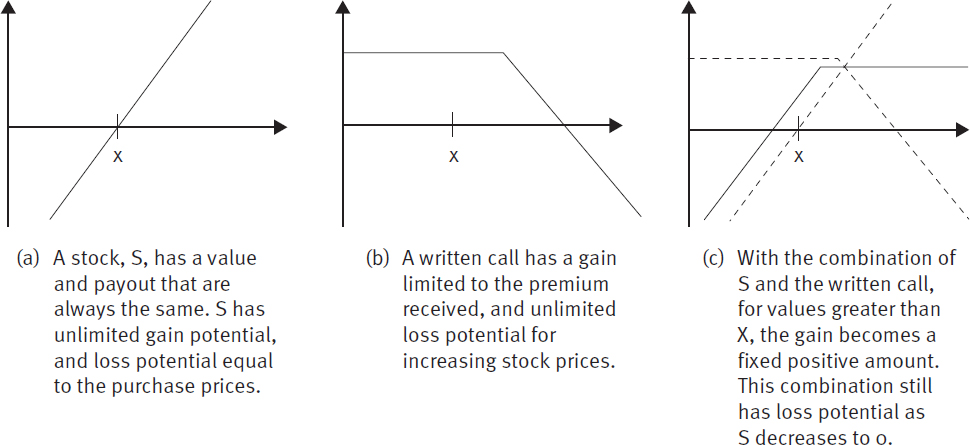

To know, we must consider what exactly is a covered call. We can do that by graphing the potential payouts at the exercise date (see Figure I.1). As with all option positions, the range of possible exercise profits and losses are known. The x-axis shows the stock price at the exercise date, and the y-axis shows profit or loss from this position. X indicates the strike price of the option.

Figure I.1 Covered Call Possible Payout

So the covered call actually pays out a fixed amount for an increasing stock price (thereby limiting potential upside) but still has the stock’s downside risk, less only the premium received.

This doesn’t sound so appealing anymore. The fact is, this is exactly the same payout that a naked put would have (see Figure I.2). There’s no difference. And finance theory tells us that two securities that have identical payouts are, indeed, the ...