APPENDIX E

Annualized Versus Average

We often mention “annualized” returns and “annualized” averages. So what is an annualized average? And is there a difference from a plain old average?

Heck, yes.

A plain old average, or what your statistics professor would call the arithmetic average (or arithmetic mean), is different from an annualized average (called the geometric average or mean). Both types have appropriate analytical uses. But when talking about returns, always use the annualized average. Why? Because arithmetic averages don’t reflect investment return reality.

For illustration’s sake, use a pretend index with crazily extreme returns. In Year 1, our index rises 75%. In Year 2, it falls 40%. In Year 3, it rises 60%. You know how to calculate the arithmetic average: add 75% + (−40)% + 60% and divide by 3—an average 31.7% return.

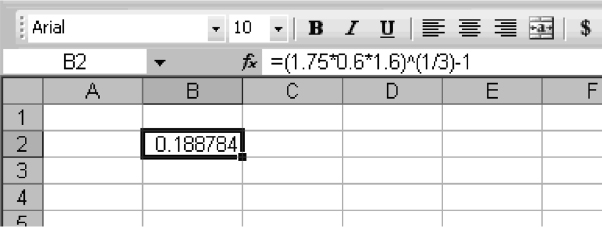

But for the annualized average (and bear with me, because it sounds ludicrous and actually isn’t hard), you must multiply 1 plus each year’s return to the power of the nth root—where n is the number of years, in this case 3. Once you’ve got that, subtract 1—giving you an annualized average of 18.88%. You can do it easily in Excel—it should look like the formula below:

I multiplied 1 plus each year’s return (75% becomes 1.75, −40% becomes 0.6, and so on), raised it with the caret to 1 over n (3 in this case), then subtracted 1.

We’ve got two very ...