Chapter 7How Bankers and Policy Rescuers Affect Stocks, Foreign Exchange, and Property

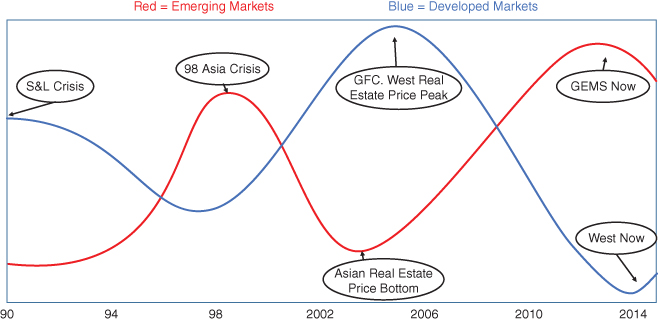

Do banks really have that much of an effect on asset prices given the other forms of credit? The answer, of course, is yes. Look at Figure 7.1. We saw this in a previous chapter and it is a vital chart for understanding the investment cycle. Global liquidity is like the phenomenon of high and low tides. There is never more or less water in the world in any one day; it is just that the moon's location affects the water. When the moon is passing over Asia, water levels in Asia are pulled up by the moon's gravitational force. Water levels in the Atlantic Ocean on the other side of the Earth are pushed lower.

Figure 7.1 Western and Eastern LDR Movements (1990–2014): Uncapped LDRs Create Massive Instability

Figure 7.1 is a vital chart that shows this effect. Right now in 2015, rates in the West are zero, and there is an extreme low tide of credit. The Western countries are together experiencing a deleveraging of balance sheets, which is necessary to correct the extreme and unsustainable imbalances caused by the global financial crisis. Some countries in the West are moving back to normalcy more quickly than others. In general, however, here is an extreme low tide underpinned by zero rates, which are necessary to help banks and businesses have wider spreads between cost of funds and returns on ...

Get The Next Revolution in our Credit-Driven Economy now with the O’Reilly learning platform.

O’Reilly members experience books, live events, courses curated by job role, and more from O’Reilly and nearly 200 top publishers.