Appendix

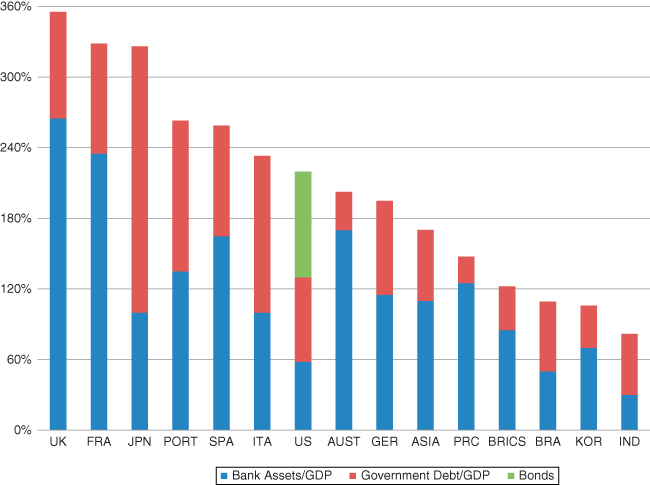

The purpose of this appendix is to show the extent to which bank credit still dominates most countries globally, even though many have advanced capital debt markets. In most countries the average bank debt/gross domestic product (GDP) stands at 121 percent, and the government debt/GDP stands at 116 percent. India's banking system still remains one of the most primitive in the world with a small bank credit/GDP ratio of less than 60 percent. The bank credit/GDP for the UK, on the other hand, is the highest in the world. This explains why the Bank of England has been keeping interest rates low in order to allow these banks to sell assets and reduce leverage. (See Figure A.1.)

Figure A.1 There Is No Doubt about It: Bank Credit Matters

Source: IMF, World Bank, CIA Factbook

Much of the world has bank loans that are about 80 percent to 90 percent of GDP. It is true that capital markets in the form of equity, corporate debt, and government debt make up a lot of the pie, but it is accurate to say that bank debt dominates globally. Even in the United States where capital markets are very advanced, bank debt still counts for about 55 percent of GDP. This is clearly significant.

Get The Next Revolution in our Credit-Driven Economy now with the O’Reilly learning platform.

O’Reilly members experience books, live events, courses curated by job role, and more from O’Reilly and nearly 200 top publishers.