2Be Business Model Driven (Step 1)What Is Business Model-Driven M&A?

If you bake in the M&A Formula at the start of each deal, even your failures will be a success. Sometimes deals will simply fail for reasons beyond your control, and that's OK. But in most cases, the warning signs are there right from the very beginning. If you follow the rules of business model-driven M&A, you can streamline this process and transform from a defensive strategy (where you are acting to avoid failure) to a pro-active offensive strategy (where you are chasing success).

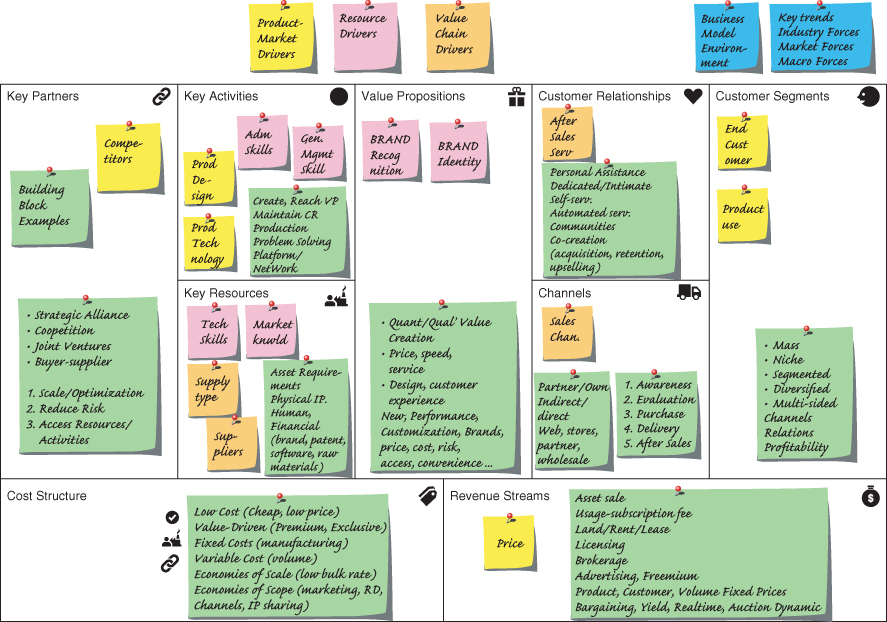

In Figure 2.1, we have spread the 16-question M&A Complementarity model in the Business Model Canvas in order for you to see how comparable they really are. The advantage of M&A Complementarity, when added to the M&A Goldman Gates, is that you can further assess if you are on a realistic mission to M&A success. You could also receive a warning sign if you are not.

Figure 2.1 SME survey in the Business Model Canvas

Business Model Complementarity and Signals for Success

When we decided to adopt an ‘M&A complementarity’ score in our M&A Formula, we faced a few practical issues.

Firstly, we wanted to do a ‘cross-check and report’ of the two M&A frameworks (‘Business Model-Driven M&A’ and ‘The Antecedents of M&A Success’). The solution to this was to simply ask our M&A Elite to fill out the same 16-question survey that was given ...

Get The M&A Formula now with the O’Reilly learning platform.

O’Reilly members experience books, live events, courses curated by job role, and more from O’Reilly and nearly 200 top publishers.