Chapter One

Everything You Know Is Wrong

Classify Your Investments the Alternative Way

There is no point chasing after alternatives while our conventional portfolio sits there like a broken-down wreck at the side of the road. After all, our conventional portfolio is going to be the source of most of our returns. It needs to be tuned up and purring like a cat. Only then can we use it to cruise around town and pick up alternatives.

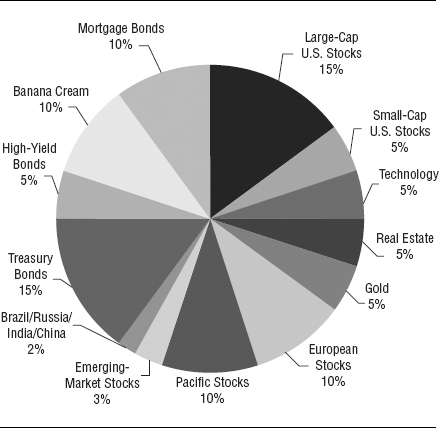

Our conventional portfolio is invariably summarized by a pie chart. Everyone loves the look of a portfolio pie. You see them in books. You see them on the Internet. You see them on your brokerage statements.

These pie charts show how our assets are invested. Each wedge is a different color. U.S. stocks might be in blue. Bonds might be in red. Emerging market stocks in yellow.

A really colorful pie chart will divide your assets into many subcategories, each one getting its own special color: Large-Cap Growth Stocks, Large-Cap Value Stocks, Municipal Bonds, Treasury Bonds, and so on. We inserted one as Figure 1.1 for your entertainment. Unfortunately, we aren’t allowed to use full-color graphics, so you’ll have to use your imagination to get the full effect. (We suggested including 3D goggles to make it really pop out, but they shot down that idea, too.)

Figure 1.1 A Portfolio Pie Chart

As exciting as these charts are, they can be extremely misleading. ...