Appendix

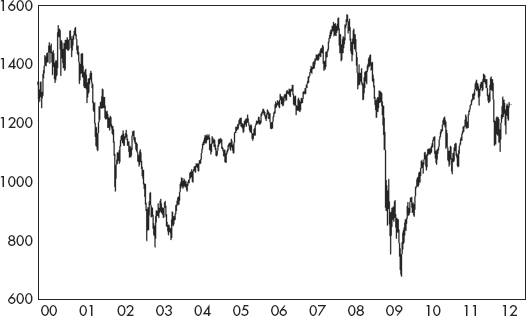

The rise and fall of the relative strength spread (RSS) measures traders’ day-to-day confidence in the immediate direction of price. Traders’ confidence crested in early 2000 as the S&P 500 reached a bull market high (Figure A.1).

FIGURE A.1 S&P 500

Since then, traders’ confidence has slowly eroded, however, evidenced by the irregular decline of the RSS (Figure A.2). A comparison of momentum during the two major rallies since 2000 is instructive. The rally from the 2003 low was attended by positive feedback and a rising RSS, but during a second advance from the 2009 low, confidence, as measured by the RSS, failed to match that of the ...

Get The Janus Factor: Trend Follower's Guide to Market Dialectics now with the O’Reilly learning platform.

O’Reilly members experience books, live events, courses curated by job role, and more from O’Reilly and nearly 200 top publishers.