Chapter Eighteen

Markets and Risk Aspects of Each Market

IN THIS CHAPTER WE COVER some of the key markets—foreign exchange (FX) markets, fixed income and money markets, equity markets and commodity markets—and the dynamics associated with each of them. We also cover some of the key economic data and indicators that emanate from governments and their broad impact on domestic markets and factors. This will set up our discussion for risk management solutions in Chapter 21.

WORLD OF MARKETS

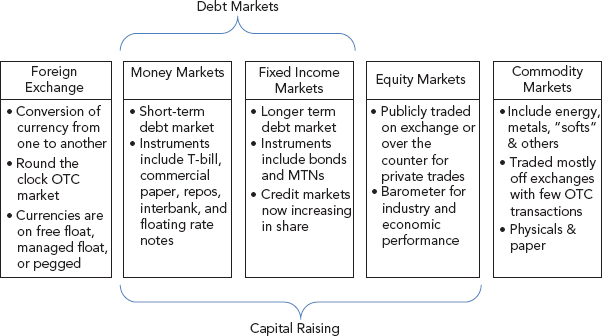

The world of markets is divided into five main asset or risk classes, as shown in Figure 18.1.

FIGURE 18.1 World of Markets

Each market has its own characteristics and dynamics, and we explore these in the rest of the chapter.

Foreign Exchange Markets

As long as international trade has been around, the need to denominate or value goods and services has been present. In ancient times, coinage and currencies were popular in different forms, but challenges arose when looking to trade across borders.

The barter system, where goods or services would be exchanged in good value for each other, became a common practice. Over time, gold came to be accepted as a universal method of exchange.

The Bretton Woods conference in the aftermath of World War II set in place the mechanics of currencies and conversion. A few hiccups later, the global foreign exchange (FX) market as we know today took shape and form, ...

Get The Handbook of Global Corporate Treasury now with the O’Reilly learning platform.

O’Reilly members experience books, live events, courses curated by job role, and more from O’Reilly and nearly 200 top publishers.