9.3 SENTIMENT REVERSAL UNIVERSES

The only variable left free in Definition 3 is P: the monthly timeframe over which net sentiment is measured. It might be helpful to think of this variable as a kind of “look-back”. As a company marches through time, how much news history about it, looking back in time at any given moment, should be incorporated into a sentiment measurement? Is one month enough or is a broader sweep of history needed? We approach this question by studying 24 distinct universes of sentiment reversals as determined by 1-month to 24-month trailing net news sentiment measurement periods. In particular, for x = 1, …, 24, define the universe Ux to be the sentiment reversals obtained by sequences of the form where m ≥ 32 and 〈N1, …, Nm〉 is a sequence of news stories about C occurring over at least one month with a relevance score of 100.

![]()

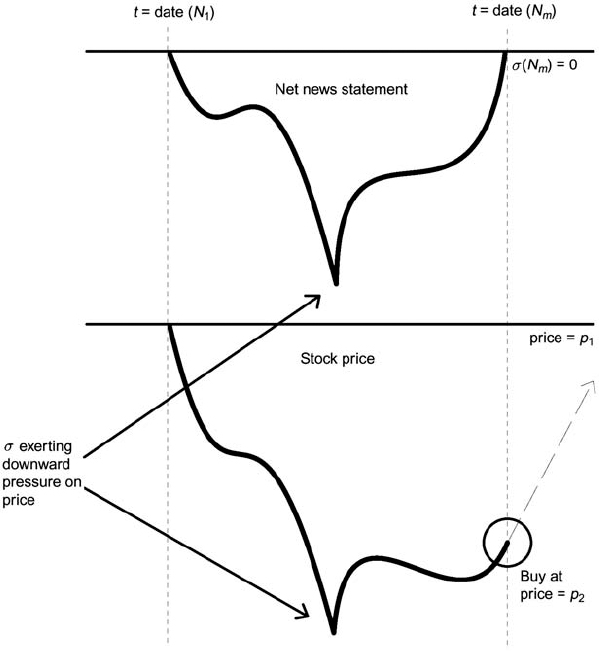

Figure 9.1. Stylized depiction of a sentiment reversal 〈N1, …Nm〉 where p1 and p2 are the closing stock prices on date (N1) and date (Nm), respectively.

Remark 2. The phrase “universe of stocks” is understood here to be a set of pairs, where in a pair one item is a security and the other item is an associated event date.

Universe sizes are further reduced by establishing a market cap minimum. This is an entirely practical consideration, ...

Get The Handbook of News Analytics in Finance now with the O’Reilly learning platform.

O’Reilly members experience books, live events, courses curated by job role, and more from O’Reilly and nearly 200 top publishers.