3.8 CONCLUSION

The importance of real-time news to the investment process has been well established, but until now there has been no systematic approach that integrates news with investments. The Thomson Reuters NewsScope Event Indices provide a convenient and powerful translation of qualitative information to quantitative signals using Thomson Reuters NewsScope data calibrated to foreign exchange spot data. The significance of the indicated market impact was verified using econometric event studies. Finally, an analysis comparing the volatility-forecasting capabilities of event indices and implied volatility indices suggested that they provide complementary information.

In ongoing research, we plan to construct customized combinations of the 45 base indices to suit a variety of applications (e.g., trading, risk management, and regulatory oversight). Moreover, we are developing a set of adaptive algorithms to automate the process by which new indices are created and old indices are updated to reflect changing market conditions.

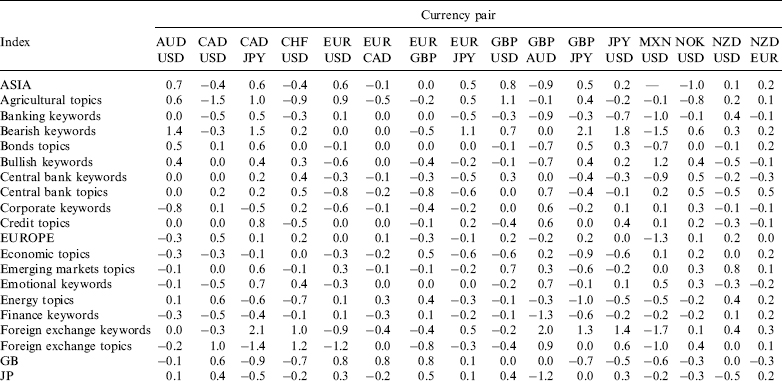

Table 3.3. t-statistics for the significance of each Thomson Reuters NewsScope Event Index with respect to the returns of 16 currency pairs.

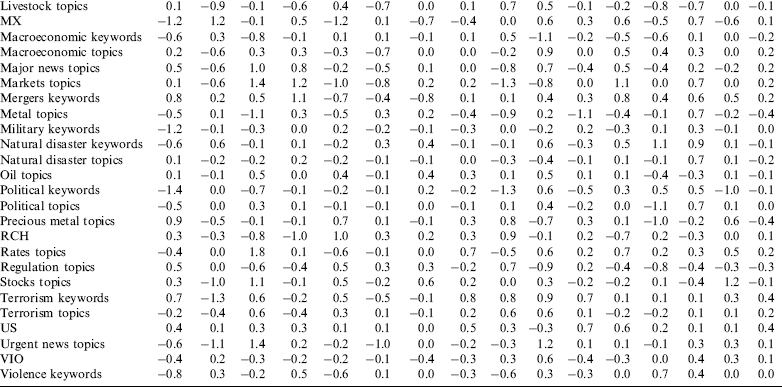

Table 3.4. t-statistics for the significance of each Thomson Reuters NewsScope Event Index with respect to the volatilities ...

Get The Handbook of News Analytics in Finance now with the O’Reilly learning platform.

O’Reilly members experience books, live events, courses curated by job role, and more from O’Reilly and nearly 200 top publishers.