APPENDIX B

Examples of Hedge Fund Structures

The purpose of this appendix is to provide you with examples of various structures used by hedge fund managers to operate their funds. The examples that follow include structures that are created by both onshore and offshore lawyers for managers around the world. The key element to the creation of a hedge fund structure is understanding where your investors are coming from. Once you understand this, your attorney can create a structure that meets the needs of your investors.

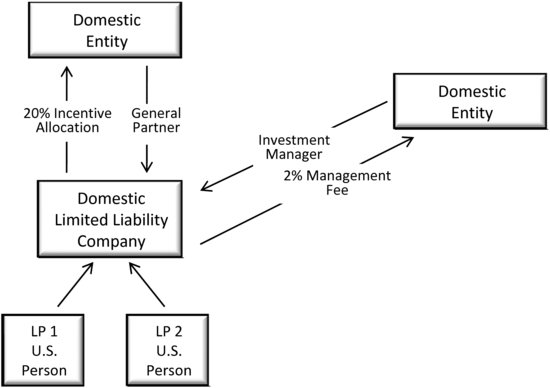

FIGURE B.1 Simple Onshore Structure This figure illustrates a classic stand-alone fund structure that simply replaces the limited partnership with a limited liability company. For reasons best known to the drafters of the fund documents, they prefer the limited liability company. The general partner can, in certain situations, suffer more adverse income tax consequences from this structure.

Source: Created and reprinted by permission of Maury Cartine, JD, CPa.

FIGURE B.2 Classic Master-Feeder Structure. In some cases, an investment manager may prefer a somewhat simpler version of the classic master-feeder structure illustrated in Figure 3.2. In this simpler version, the offshore partnership is eliminated and so is one audit. The auditors will only have to audit the domestic fund and the offshore feeder corporation. However, the general partner of the domestic ...

Get The Fundamentals of Hedge Fund Management, 2nd Edition now with the O’Reilly learning platform.

O’Reilly members experience books, live events, courses curated by job role, and more from O’Reilly and nearly 200 top publishers.