CHAPTER 3 The United States in Balance Sheet Recession

The last chapter pointed out that the United States was able to maintain relatively robust economic growth by quickly abandoning the agreement made at the Toronto summit in 2010. But the road was not an easy one. The U.S. economy had been in a balance sheet recession since 2008, but a lack of understanding of the problem led to numerous policy missteps at the beginning.

The officials in charge of economic policy today, however, fully understand the risks of balance sheet recessions. Consequently, the United States is in a much better position than Europe, where policymakers are completely unaware of the rare economic sickness that is infecting their economies.

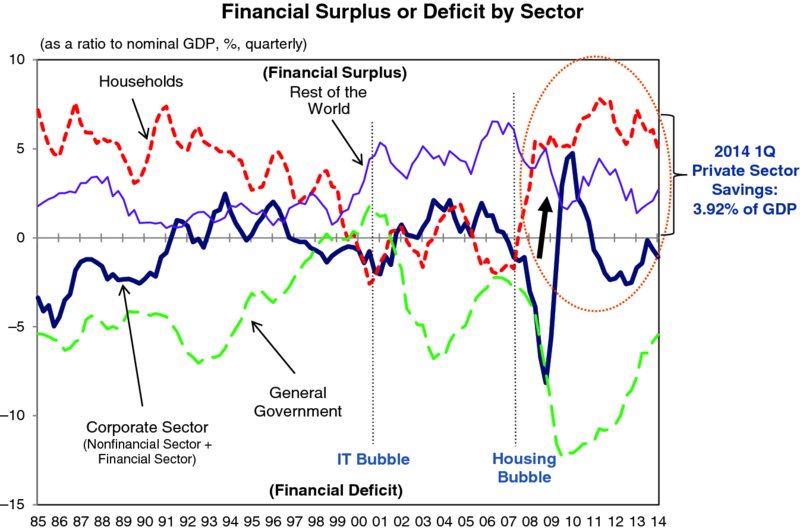

Figure 3.1 shows flow-of-funds data for the United States. The line for the household sector, the driver of the recent housing bubble, was below zero during the bubble, which means households borrowed more than they saved, while after the bubble burst households began saving more each year in spite of zero interest rates. As U.S. households were described as the key source of final demand to the global economy, the sudden increase in their savings triggered a sharp slowdown in both the U.S. and the global economies. After 2007 U.S. households no longer lived up to their decades-long reputation as perennial borrowers.

Figure 3.1 United States in Balance Sheet Recession—U.S. ...

Get The Escape from Balance Sheet Recession and the QE Trap: A Hazardous Road for the World Economy now with the O’Reilly learning platform.

O’Reilly members experience books, live events, courses curated by job role, and more from O’Reilly and nearly 200 top publishers.