CHAPTER 1 Balance Sheet Recession Theory—Basic Concepts

The greatest similarity between the Western economies today and the Japanese economy of 20 years ago is that both experienced the collapse of a massive, debt-financed bubble. Balance sheet recessions occur only when a nationwide asset bubble financed by debt bursts. Since nationwide debt-financed bubbles occur only rarely, balance sheet recessions are few and far between.

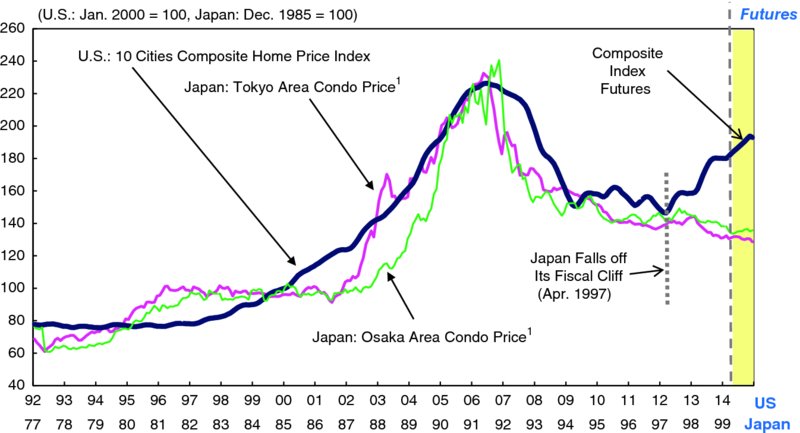

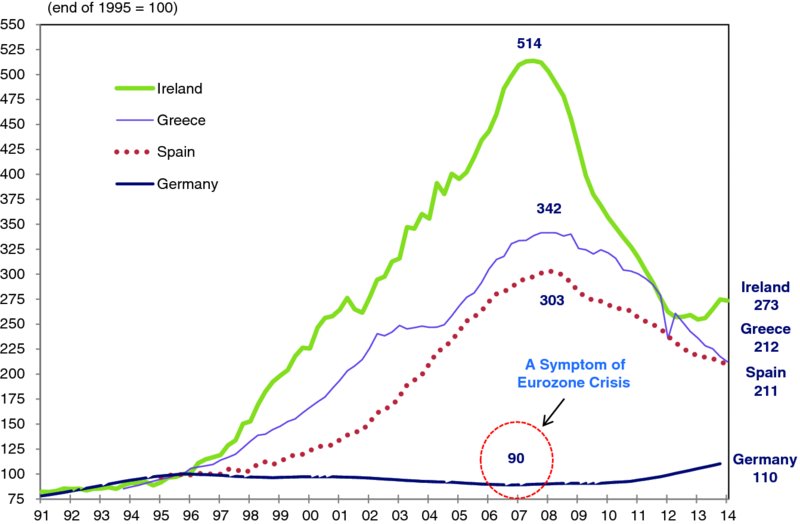

Figure 1.1 compares conditions in the U.S. housing market with those in Japan 15 years earlier. As the graph shows, the two markets trod identical paths in terms of the magnitude of the increase in prices, the duration of that increase, the magnitude of the subsequent decline in prices, and the duration of that decline. In other words, the United States can now expect to face the same set of conditions that Japan once did. The situation in Europe is similar (Figure 1.2).

Figure 1.1 The U.S. Housing Bubble Comparable to the Japanese Housing Bubble 15 Years Earlier

Note: Per m2, five-month moving average

Sources: Bloomberg; Real Estate Economic Institute, Japan; S&P, S&P/Case-Shiller® Home Price Indices, as of June 6, 2014.

Figure 1.2 Europe's Experiences with House Price Bubbles

Notes: Ireland's figures before 2005 are existing house prices only. ...

Get The Escape from Balance Sheet Recession and the QE Trap: A Hazardous Road for the World Economy now with the O’Reilly learning platform.

O’Reilly members experience books, live events, courses curated by job role, and more from O’Reilly and nearly 200 top publishers.