6

Cointegration with Traditional Asset Markets

This chapter contains a cointegration analysis between representative indices of commodity markets (i.e. the GSCI indices) and traditional asset markets. More particularly, we are interested in determining the extent to which commodity markets may vary together with the time series of equities, bonds and exchange rates.

Following unit root test results, the cointegration analysis between commodities and asset markets unfolds as follows: we study first the influence of the S&P 500 and the US 10-year rate, and second the influence of exchange rates.

6.1 DATASET AND UNIT ROOT TEST RESULTS

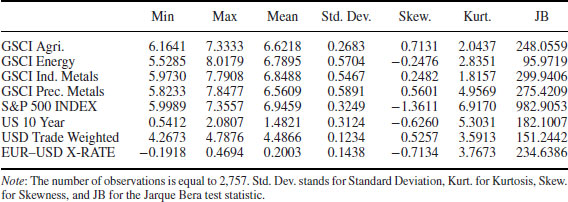

Table 6.1 shows the descriptive statistics for the equities, bonds and exchange rate variables studied in Chapter 6, in conjunction with GSCI sub-indices (instead of individual commodity price series as in the previous chapter). In what follows, USD Trade Weighted is a trade-weighted index of the US Dollar, and EUR-USD X-RATE denotes the Euro–Dollar exchange rate. All the data comes from Bloomberg with a daily frequency.

Table 6.1 Descriptive statistics for the GSCI sub-indices, equities, bonds and exchange rates

The time series are shown in Figure 6.1 for the GSCI sub-indices, in Figure 6.2 for equities and bonds, and in Figure 6.3 for exchange rate variables. While we remark on the recent variability of the GSCI sub-indices (especially energy) following ...

Get The Economics of Commodity Markets now with the O’Reilly learning platform.

O’Reilly members experience books, live events, courses curated by job role, and more from O’Reilly and nearly 200 top publishers.