Welcome to the jungle54

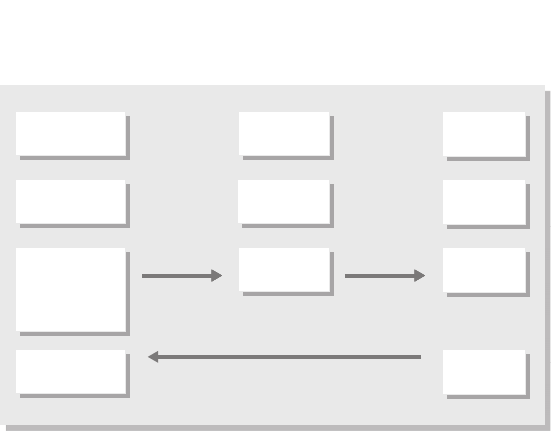

Another time Jerry explained how investment banks made their

money.

‘Different investment banks may look very similar to outsiders.

They normally split into three main areas of business: investment

banking and advisory, asset management and trading. Within these

broad groupings, however, there are many different functions.

Some banks may have a huge trading oor, others may be more

focused on asset management.

‘Investment banks carry out nancial advisory work for clients.

This section of the investment bank – sometimes known as

mergers and acquisitions or the investment banking division – is

responsible for raising capital via share and bond issues. These

transactions are extremely lucrative and banks will ght to the

death for a client mandate.’

It’s raining middlemen

‘Investment banking is a classic middleman business. You can think

of it as a simple diagram. On the left-hand side we have institutional

investors. Insurers, pension fund managers and the treasuries of big

businesses create huge volumes of work for investment banks. They

are cash-rich and need to invest. Institutional investors are assumed

to know their way around nance, so in most countries they will get

less protection from regulators even though the amount of money

at risk is massive.

‘Think of the pressure facing a pension fund. It receives your

pension payment, plus the payments of all the people in your

department, and all the other people in your rm, plus money

from people who work at suppliers and customers and compet-

itors, and their neighbours, wives, husbands and mates from the

gym. Every month the pension fund has a mountain of money

to invest.’

Jerry encouraged me to understand what kept Saiwai’s clients

awake at night. He used this diagram to show how investment

banks make money.

55Damn clients

‘Putting it in a bank account and playing golf for the next forty

years isn’t an option. Decisions on risk tolerance and asset

allocation have to be made. The pension fund will have a list of

investment banks which can advise it on equities, bonds, deriva-

tives and alternative investments.’

The lift stopped. Outside was the junior trader who I last saw

being torn apart by his boss for screwing up the breakfast order.

It was clear from the pile of pizza boxes balanced between his

burning hands that progress had not been rapid.

‘Who’s that?’ I asked.

Jerry pushed the shut button so the lift wouldn’t open. ‘He’s

called Jonathan Spurrier. He’s as much use as a chocolate

reguard.’ Without missing a beat Jerry continued with his

explanation.

‘Analysts are paid to generate ideas which salespeople can present

to clients. The investment bank makes money by charging

commissions to its clients. A dream call for a salesman is a switch,

where the pension fund sells Portuguese bonds and buys Danish

derivatives with the same money. This generates both a selling

and a buying commission for the bank – and, of course, the

salesman and the analyst.

Investors

Companies

Investment

banks

Have capital

Need to invest

Need

capital

Middlemen

Fund managers

Pension funds

Insurance

companies

Investment

Fees

Commissions

Dividends

Coupon interest

Returns

Get The Devil's Deal now with the O’Reilly learning platform.

O’Reilly members experience books, live events, courses curated by job role, and more from O’Reilly and nearly 200 top publishers.