One-way ticket38

to return to his old job in IT. That paid €2,300 per month, so the

aloof and brooding Frenchman will need to keep working until he

is 177,569 years old to pay back his losses. If he takes no holidays,

that is.

s

Buys and sells

Outside the sky darkened. The mysterious Mr Conrad had fallen

silent but Anisa was still full of questions. ‘What does it mean

when investments don’t plot on the expected line of risk and

return?’

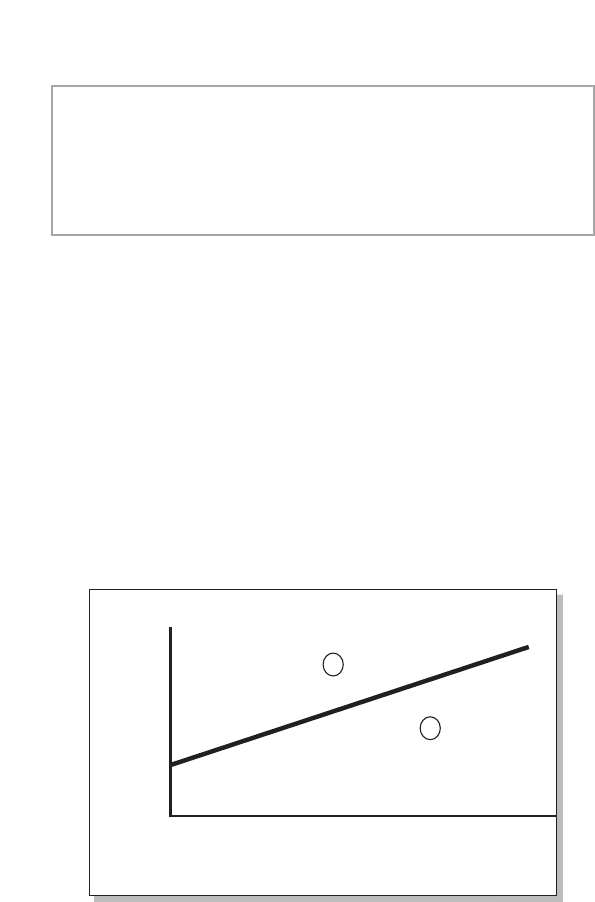

‘Look at the graph now. I’ve got Investment A and Investment

B. Neither of them can be plotted on the line of correlation.

How are they different and what is the message they send to

investors?’

Return

Low Medium

Risk

A

B

High

Attractive investments are found above the line

Anisa correctly rated Investment A as a strong buy. ‘I’d ll

my boots with it!’ she announced, to Conrad’s amusement.

39The leap of faith

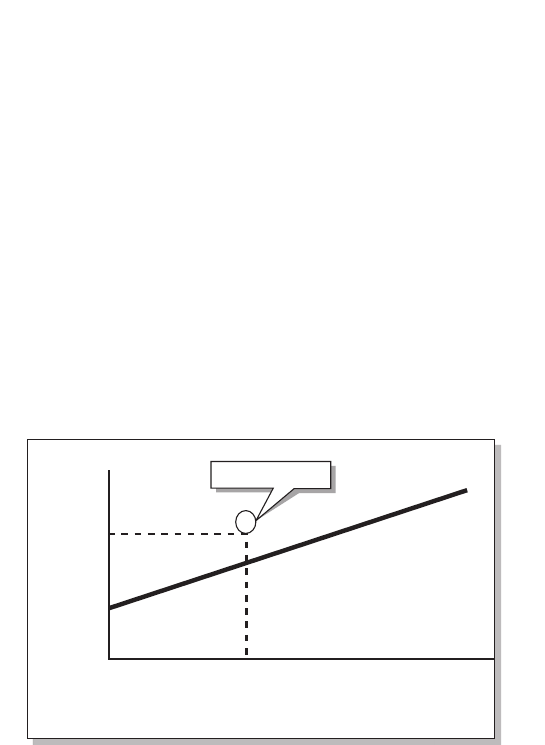

‘Investment A is above the line. For a given level of risk, it’s giving

investors more return than they’d expect. You’ve got to buy it!’

I nodded at her to carry on.

‘If you buy Investment A before other investors do and they

follow you, their purchase orders will push the price of the

investment up until risk and return are aligned again. You

capture that price rise if you do good analysis, act early and

convince the market to follow you. If everything works, there’s

your capital gain.’

Anisa’s explanation was perfect, so I drew the two dotted lines in

her notebook.

Return

17%

8%

Low Medium

Risk

A

High

Above the line

‘You can see that most low/medium risk investments will give

you about 7 per cent return per year. But Investment A, which

has the same low/medium level of risk, is giving you 17 per cent.

Any investment which plots above the line is giving us more

return than the risk deserves. And that makes Investment A such

a clear buy.’

Investments below the line are to be avoided

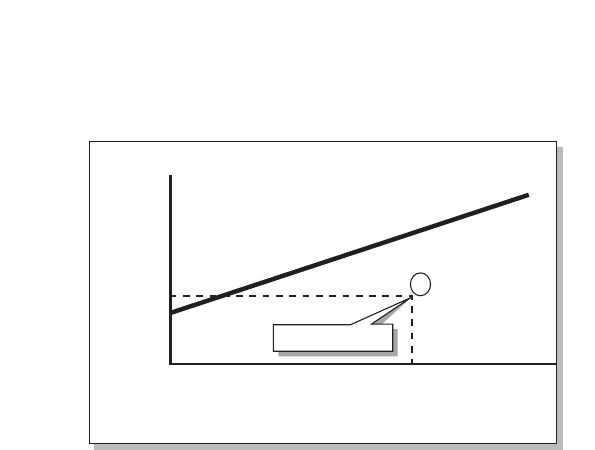

‘Now, take a look at Investment B. Anisa, what do you reckon?’

‘It’s higher risk, but investors aren’t getting the return they deserve.’

One-way ticket40

‘Correct.’ I drew the two dotted lines on the ipchart.

Return

15%

6%

Low Medium

Risk

High

Below the line

B

‘Investment B is medium/high risk, so investors look for a return

about 15 per cent per annum. But the return is a paltry 6 per

cent. They should sell any investment below the line.

‘Bear in mind that investors can make money out of selling

investments as well as buying them. If they sell Investment B

before other people, and then other people follow them, then

the price will fall. What smart investors do now is buy back

the investment and return it to their portfolio. They have the

same investment but they’ve bought it at a lower price. So,

they’ve made money – or at least saved money – by the fall

in price.

‘A word of warning before you rush to set up your own private

trading oors. Both these approaches will only work when two

conditions are met. First, your analysis must be correct and,

second, enough people must follow you. The investment world

is littered with people who’ve done analysis which has been too

obscure, too complicated or too unpopular to be accepted by the

rest of the market. Or just wrong.’

Anisa asked a smart question. ‘What examples can you give of

Investment A and Investment B? I’m looking to make some fast

bucks when I get back to London!’

Get The Devil's Deal now with the O’Reilly learning platform.

O’Reilly members experience books, live events, courses curated by job role, and more from O’Reilly and nearly 200 top publishers.