23Taking risks

‘You’ve got three different shares. Which of the three companies

is the safest? Is it the supermarket, the luxury holiday company,

or Russian oil?’

The luxury gap

Staple products make for safer shares

‘The supermarket,’ said Anisa.

‘Why?’

‘The products it sells are day-to-day essentials. Sales of staple

products like bread or toilet roll don’t vary much with the

Rely on a fantasist for the majority of your profits, and make

sure no one controls him. Nick Leeson’s unsupervised trading

in derivatives reduced the value of Barings, Britain’s oldest and

stuffiest merchant bank, to a single, solitary pound.

Get left behind with your technology, and then think everybody

else has got it wrong. Hands up if you thought that iPhones,

BlackBerrys and Androids were not going to take over the world.

That’s what Nokia believed, and they lost their pre-eminent global

position in mobiles as a result.

Make faulty products, and try to hide their defects. Selling cars

that go faster when you press on the brake pedal can never be a

viable long-term strategy. Toyota’s reported refusal to come clean

led to hundreds of liability suits in the US, a country not known for

low legal costs.

Keep your customers in the dark, and hope they don’t

notice. Coca-Cola’s launch of the British version of Dasani, its

bottled water, was a disaster. The water was marketed as being

wonderfully pure, but the customers were dismayed to learn

that its source was a tap in Sidcup, a suburb of London not

synonymous with natural springs. Bad publicity meant that Coca-

Cola canned the product’s launch across Europe.

One-way ticket24

economic climate. People will drink the same quantity of tea

whether the stock market is up or down.’

‘You’re right,’ I said. ‘Sales are always going to be pretty steady,

whatever happens to variables such as ination, unemployment

or the yield to maturity on a forty-year Tibetan government zero

bond.’

Government bond in your country Safest

Shares in a supermarket Low risk

3 Medium risk

4 High risk

‘That leaves us with luxury holidays or Russian oil. What’s it to

be?’

Anisa delayed her response. ‘Both of them seem risky to me. To

be honest, I can’t decide between them.’

Luxuries make for more risky shares

‘There are two factors which drive luxuries. The rst is the

economy and the second is the strength of the brand.’

‘Let’s start with what’s happening in the economy. Are we

enjoying a massive boom or are we stuck in a deep recession?

Imagine this bank has a fantastic year and decides to pay you

a mega-bonus. What are you going to spend it on? Luxury

holidays, or more cornakes from the supermarket?’

‘I’m obviously going to spend more on luxuries,’ Anisa said. ‘But

my consumption of staple goods will stay pretty much the same.

During a boom the luxury holiday company is going to have

great sales.’

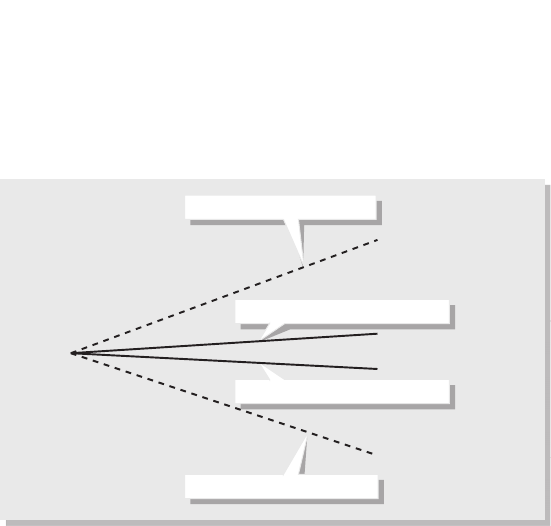

‘That’s right. A 2 per cent increase in economic activity might

lead to a 20 per cent increase in sales. Sadly the opposite is also

true. If economic activity falls by 2 per cent, sales of luxury goods

may drop by 20 per cent. But a supermarket remains relatively

25Taking risks

unaffected by the economic climate. It may sell more lobster and

pro teroles during a boom, and more white sliced bread and

baked beans during a recession, but core sales will stay the same.’

Luxury holiday sales – big rise

Economic

growth

3%

Sales

growth

20%

2%

0%

–2%

–20%

0%

–3%

Luxury holiday sales – big drop

Supermarket sales – small increase

Supermarket sales – small decrease

‘Luxury goods – expensive holidays, smart cars, branded clothing

– represent discretionary spending. They are not essential. You

only buy them when you’re feeling wealthy and con dent about

the future.’ (We’ll go deeper into slumps and booms in Chapters

20–22.)

‘But what about the super-rich?’ she asked. ‘Aren’t they insulated

from swings in the economy?’

‘Yes. David Beckham won’t cut back on his Armani because of a

rise in unemployment. But many customers will, and these are

the people who make most of the money for the luxury goods

companies. If the economy is booming, you might well be happy

to buy a pair of Jimmy Choo sandals for $400. But if you’re

scared about nding your rent that month, you’ll probably keep

your old ones or buy a cheaper brand. And that’s why a lot of

luxury goods companies lose their appeal for investors when the

economy is going bad.’

Get The Devil's Deal now with the O’Reilly learning platform.

O’Reilly members experience books, live events, courses curated by job role, and more from O’Reilly and nearly 200 top publishers.