Why Do Risk Premiums Matter?

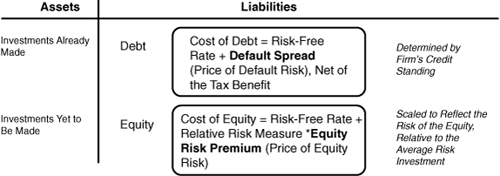

The price of risk is key to assessing the cost of funding to a firm. We can use the financial balance sheet introduced in Chapter 1 to illustrate this concept, as shown in Figure 7.1.

Note that both the cost of equity and the cost of debt are a function not only of the risk characteristics of the business being analyzed—its credit standing and relative risk measure—but also of the market prices that we attach to default risk (default spread) and the equity risk (equity risk premium). The latter applies across all investments, whereas the ...

Get The Dark Side of Valuation: Valuing Young, Distressed, and Complex Businesses, Second Edition now with the O’Reilly learning platform.

O’Reilly members experience books, live events, courses curated by job role, and more from O’Reilly and nearly 200 top publishers.