Closing Thoughts on Risk-Free Rates

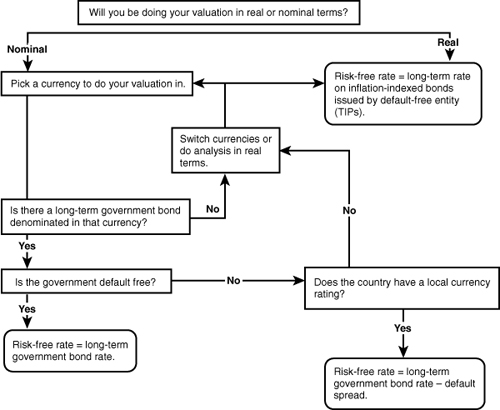

Looking at the bigger picture, we can break the estimation of a risk-free rate into steps, starting with a choice of currency and working down to include views on future rate levels. The steps are captured in Figure 6.7.

Summarizing the key points made in this chapter, we would list the following as the key rules to follow when it comes to risk-free rates:

A risk-free rate should be truly free of risk. A rate that has risk spreads embedded in it for default or other factors is not a risk-free rate. This is why we argued that local ...

Get The Dark Side of Valuation: Valuing Young, Distressed, and Complex Businesses, Second Edition now with the O’Reilly learning platform.

O’Reilly members experience books, live events, courses curated by job role, and more from O’Reilly and nearly 200 top publishers.