The Essence of Real Options

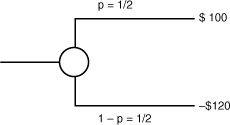

To understand the basis of the real options argument and the reasons for its allure, it is easiest to go back to the risk-assessment tool unveiled in Chapter 3—decision trees. Figure 5.1 shows a simple example of a decision tree.

Figure 5.1. Simple Decision Tree

Given the equal probabilities of up and down movements, and the larger potential loss, the expected value for this investment is negative:

| Expected Value = 0.50 (100) + 0.5 (–120) = –$10 |

Now contrast this with the slightly more complicated two-phase decision tree shown in Figure 5.2.

Figure 5.2. Two-Phase Decision Tree

Note that the total potential profits ...

Get The Dark Side of Valuation: Valuing Young, Distressed, and Complex Businesses, Second Edition now with the O’Reilly learning platform.

O’Reilly members experience books, live events, courses curated by job role, and more from O’Reilly and nearly 200 top publishers.