3.4. Money Problems

Our next group of applications is in an area that concerns us all, on the job and especially in our private lives: money.

We usually work financial problems to the nearest dollar or nearest penny, regardless of the significant digits in the original numbers.

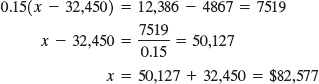

Example 30:A consultant had to pay income taxes of $4867 plus 15% of the amount by which her taxable income exceeded $32,450. Her tax bill was $12,386. What was her taxable income? Work to the nearest dollar. Solution: Let x = taxable income (dollars). The amount by which her income exceeded $32,450 is then

Her tax is 15% of that amount, plus $4867, so

Solving for x we get

Check: Her income exceeds $32,450 by ($82,577 − $32,450) or $50,127. A 15% tax on that amount is 0.15($50,127) or $7,519. Her total tax is then $7,159 + $4867 or $12,386, as required. |

Example 31:A person invests part of his $10,000 savings in a bank, at 6%, and part in a certificate of deposit, at 8%, both simple interest. He gets a total of $750 per year in interest from the two investments. How much is invested at each rate? Solution: We first define our variables. Let

and

If x dollars are invested at 6%, the interest on that investment is 0.06x dollars. Similarly, 0.08(10,000 − x) dollars are earned on the other investment. ... |

Get Technical Mathematics, Sixth Edition now with the O’Reilly learning platform.

O’Reilly members experience books, live events, courses curated by job role, and more from O’Reilly and nearly 200 top publishers.