Chapter 1. What Are Gaps?

Gaps have attracted the attention of market technicians since the earliest days of stock charting. A gap occurs when a security’s price jumps between two trading periods, skipping over certain prices. A gap creates a hole, or a void, on a price chart.

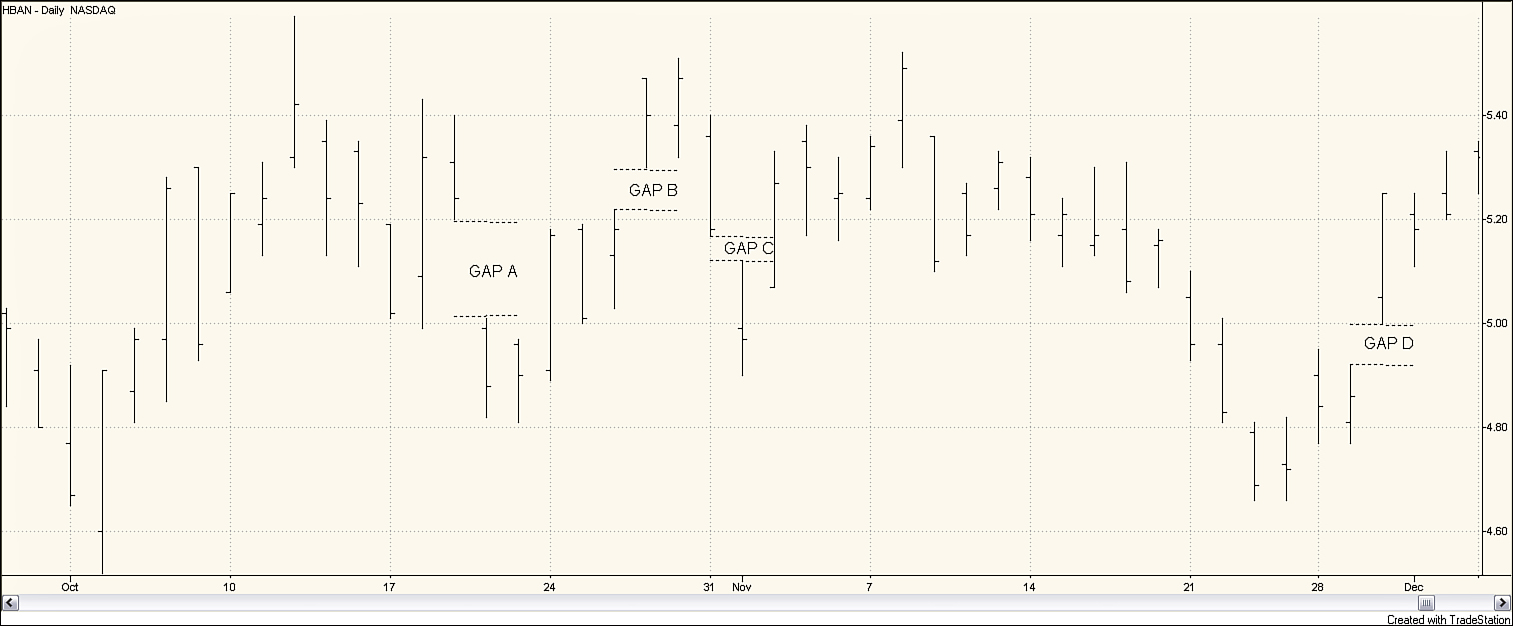

Because technical analysis has traditionally been an extremely visual practice, it is easy to understand why early technicians noticed gaps. Gaps are visually conspicuous on a price chart. Consider, for example, the stock chart for Huntington Bancshares (HBAN) in Figure 1.1. A quick glance at the price activity reveals four gaps.

Created with TradeStation

Figure 1.1. Gaps ...

Get Technical Analysis of Gaps: Identifying Profitable Gaps for Trading now with the O’Reilly learning platform.

O’Reilly members experience books, live events, courses curated by job role, and more from O’Reilly and nearly 200 top publishers.