APPENDIX C

SAMPLE FILLED-IN TAX RETURNS

SAMPLE RETURN 1 (SR1)

INFORMATION FOR CORPORATE TAX RETURN

Facts

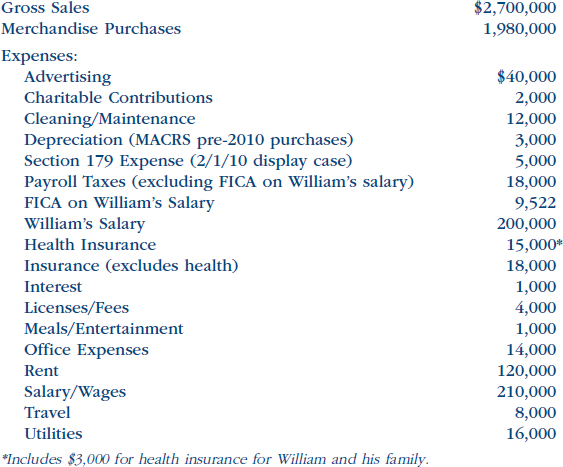

William Spicer (SS# 123-45-6789) owns 80 percent of the stock in Bill's Market, a cash-basis gourmet food market operating as a corporation. It is located at 387 Spring Street, Raleigh, NC 29288. William's wife, June (SS# 987-65-4321), owns the other 20 percent of the outstanding stock of the corporation but she is not active in the business. The Market's EIN is 79-7979797 and its business code is 445290. It was incorporated on July 15, 2001. During the last tax year, the Market had the following results from its operations:

The Market sold a unique piece of equipment for $13,000. It had originally cost $5,000 when purchased on March 5, 2008; it had an adjusted basis of $3,000 when sold on August 15, 2010. The Market also sold a display case for $1,000 on December 12, 2010, that had cost $12,000 when purchased on June 6, 2006; it had an adjusted basis of $4,000 when sold. The gains or losses on these asset sales are the same for tax and financial accounting.

Information specific to the corporate form: The corporation made estimated payments for its own taxes of $10,000 and withheld $45,000 from William's salary for income taxes. For financial accounting, the corporation does not expense the new display case but deducts $1,000 of depreciation expense. It has a beginning balance ...

Get Taxation for Decision Makers, 2012 Edition now with the O’Reilly learning platform.

O’Reilly members experience books, live events, courses curated by job role, and more from O’Reilly and nearly 200 top publishers.