CHAPTER 5Capital Preservation Strategies

I’m more concerned with the return of my money than the return on my money.

—Mark Twain

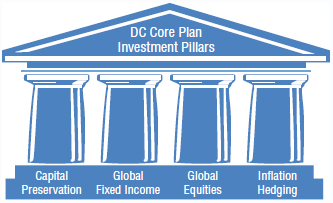

Part One of this book provided a DC design framework along with suggestions for governance, investment structure, and target-date strategies. In Part Two, we will consider how to fill the core investment lineup with a chapter dedicated to each of the four core risk pillars: capital preservation, fixed income, equity, and inflation hedging (as shown in Figure 5.1). Plus, we provide a chapter on additional strategies such as global balanced and alternatives. In each chapter, we’ll consider a range of strategies, share insights from plan sponsors, consultants, and other experts, then offer an analytical framework to evaluate potential investment choices. We start off with a look at capital preservation choices, including money market funds (MMFs), stable value, and short-term bond alternatives.

FIGURE 5.1 The Four Pillars of Well-Balanced Core Lineups

Source: PIMCO.

CAPITAL PRESERVATION: IMPORTANCE

The aphorism by Mark Twain that opens this chapter presents a common sentiment, one that explains why capital preservation strategies, long a cornerstone in DC plans, are also among its most popular offerings. As the name implies, these strategies are meant to allow participants to prioritize the preservation of invested principal; return may be of ...

Get Successful Defined Contribution Investment Design now with the O’Reilly learning platform.

O’Reilly members experience books, live events, courses curated by job role, and more from O’Reilly and nearly 200 top publishers.