Chapter 23

STANDARD COSTS AND BALANCED SCORECARD

CHAPTER LEARNING OBJECTIVES

After studying this chapter, you should be able to:

1. Distinguish between a standard and a budget.

2. Identify the advantages of standard costs.

3. Describe how companies set standards.

4. State the formulas for determining direct materials and direct labor variances.

5. State the formula for determining the total manufacturing overhead variance.

6. Discuss the reporting of variances.

7. Prepare an income statement for management under a standard costing system.

8. Describe the balanced scorecard approach to performance evaluation.

*9. Identify the features of a standard cost accounting system.

*10. Compute overhead controllable and volume variance.

*Note: All asterisked (*) items relate to material contained in the Appendices to the chapter.

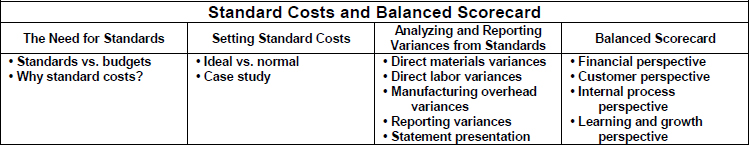

PREVIEW OF CHAPTER 23

In this chapter we continue the study of controlling costs by considering additional measures that permit the evaluation of performance. The content and organization of the chapter are as follows:

CHAPTER REVIEW

Standards and Budgets

- (L.O. 1) In concept, standards and budgets are essentially the same. Both are predetermined costs and both contribute significantly to management planning and control.

- A standard is a unit amount, whereas a budget is a total amount.

- Standard costs may be incorporated into a cost accounting system.

Why ...

Get Study Guide Vol 2 t/a Accounting: Tools for Business Decision Makers, 5th Edition now with the O’Reilly learning platform.

O’Reilly members experience books, live events, courses curated by job role, and more from O’Reilly and nearly 200 top publishers.