Chapter 19

COST-VOLUME-PROFIT ANALYSIS: ADDITIONAL ISSUES

CHAPTER LEARNING OBJECTIVES

After studying this chapter, you should be able to:

1. Describe the essential features of a cost-volume-profit income statement.

2. Apply basic CVP concepts.

3. Explain the term sales mix and its effects on break-even sales.

4. Determine sales mix when a company has limited resources.

5. Understand how operating leverage affects profitability.

*6. Explain the difference between absorption costing and variable costing.

*7. Discuss net income effects under absorption costing versus variable costing.

*8. Discuss the merits of absorption versus variable costing for management decision making.

*Note: All asterisked (*) items relate to material contained in the Appendix to the chapter.

PREVIEW OF CHAPTER 19

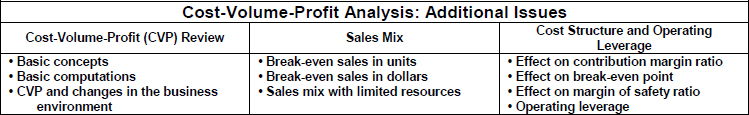

The relationship between a company's fixed and variable costs can have a huge impact on its profitability. In particular, the trend toward cost structures dominated by fixed costs has significantly increased the volatility of many companies' net income. The purpose of this chapter is to demonstrate additional uses of cost-volume-profit analysis in making sound business decisions. The content and organization of this chapter are as follows:

CHAPTER REVIEW

Cost-Volume-Profit Income Statement

1. (L.O. 1) The Cost-Volume-Profit (CVP) income statement classifies costs as variable or fixed and ...

Get Study Guide Vol 2 t/a Accounting: Tools for Business Decision Makers, 5th Edition now with the O’Reilly learning platform.

O’Reilly members experience books, live events, courses curated by job role, and more from O’Reilly and nearly 200 top publishers.