Chapter 17

ACTIVITY-BASED COSTING

CHAPTER LEARNING OBJECTIVES

After studying this chapter, you should be able to:

1. Recognize the difference between traditional costing and activity-based costing.

2. Identify the steps in the development of an activity-based costing system.

3. Know how companies identify the activity cost pools used in activity-based costing.

4. Know how companies identify and use the activity cost drivers in activity-based costing.

5. Understand the benefits and limitations of activity-based costing.

6. Differentiate between value-added and non-value-added activities.

7. Understand the value of using activity levels in activity-based costing.

8. Apply activity-based costing to service industries.

*9. Explain just-in-time (JIT) processing.

*Note: All asterisked (*) items relate to material contained in the Appendix to the chapter.

PREVIEW OF CHAPTER 17

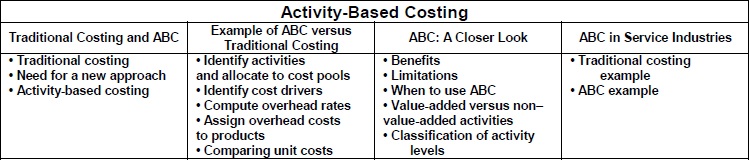

Traditional costing systems are not the best answer for every company. Sometimes a traditional system can mask significant differences in its real cost structure. New management tools have been developed that allow businesses to gather more accurate data for decision-making purposes, including activity-based costing (ABC). The content and organization of this chapter are as follows:

CHAPTER REVIEW

Traditional Costing And Activity-Based Costing

- (L.O. 1) Often the most difficult part of computing accurate ...

Get Study Guide Vol 2 t/a Accounting: Tools for Business Decision Makers, 5th Edition now with the O’Reilly learning platform.

O’Reilly members experience books, live events, courses curated by job role, and more from O’Reilly and nearly 200 top publishers.