CHAPTER 16

Review and Monitoring

Reporting back to the board or investment committee is essential to effectively manage monitoring risk. Every aspect of the governance arrangement and investment process should be monitored and appropriately evaluated. Good investment reports are necessary to communicate essential information so that any issues can be clearly identified and effective solutions reached.

LEVELS OF PERFORMANCE REPORTING

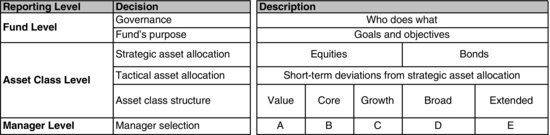

Any fund's portfolio can usually be split into three levels performance reporting: fund level, asset class level, and manager level. These are represented diagrammatically in Figure 16.1.

Figure 16.1 Levels of Reporting

Fund Level

At this level the total fund return is measured and compared to the fund's return objective and strategic asset allocation, or benchmark, return. In the case of a defined benefit plan, the funding discount rate (that is used in the actuarial funding valuation) would also be presented.

Asset Class Level

At the asset class level, the performance of different investment strategies for each asset class is measured. A variety of manager structures may be employed. For a single-manager structure, the performance of the manager's portfolio is measured relative to the manager's benchmark return. The separate effects of the manager's security selection decisions can be accounted for at this level. The asset allocation timing decisions ...

Get Strategic Risk Management: A Practical Guide to Portfolio Risk Management now with the O’Reilly learning platform.

O’Reilly members experience books, live events, courses curated by job role, and more from O’Reilly and nearly 200 top publishers.