CHAPTER 7

Private Equity

The term “private equity” can be defined most broadly as ownership in nonpublic companies.

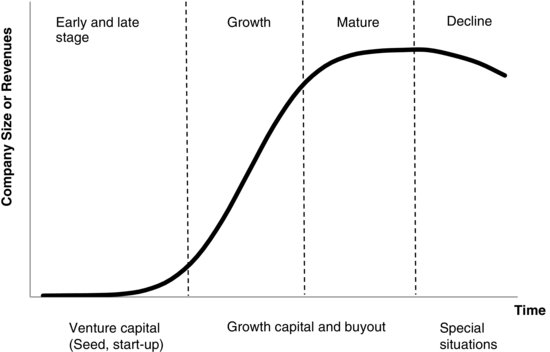

Private equity includes not only financing to start up a business, but also covers financing required for subsequent growth stages during its life cycle. The contractual relationship is usually via limited partnership, which allows the investor to provide capital to the private equity specialist manager for investment in attractive businesses. Private equity is typically categorized into subsectors that match the capital requirements of companies over their lives. The types of capital over a company life cycle are shown in Figure 7.1. Venture capital provides capital to turn an idea into a business. Growth capital provides financing to successful start-up companies. Buyout capital is used for buying a business from a much larger company.

Figure 7.1 Stages in the Company Life Cycle

The main benefits from investing in private equity accrue to the investor when a company is listed or an unprofitable company is restructured successfully.

TYPES OF PRIVATE EQUITY

There are three major investment types:

- Seed capital—financing ...

Get Strategic Risk Management: A Practical Guide to Portfolio Risk Management now with the O’Reilly learning platform.

O’Reilly members experience books, live events, courses curated by job role, and more from O’Reilly and nearly 200 top publishers.