23

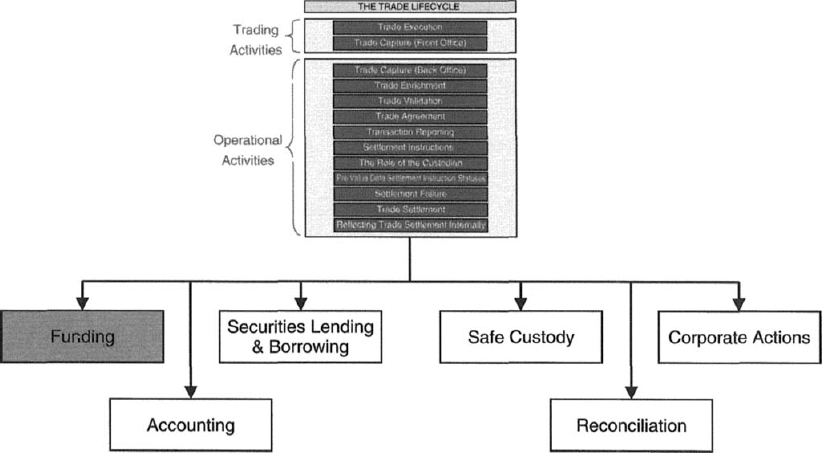

Funding

23.1 INTRODUCTION

Following settlement of a purchase of securities on a DvP basis, the STO will be:

- positive of securities, and

- negative of cash (unless a prior credit balance existed)

at the custodian.

The securities typically remain in the STO's account at the custodian until either sold, or repo'd, or lent (the latter will be explored in Chapter 24).

As for a cash overdraft, unless the rate of interest charged by the custodian is reasonable when compared with money market rates, an excessive overdraft cost will have a direct detrimental impact on the STO's P&L. Consequently, STOs typically attempt to minimise the cost of funding their positive securities positions, by borrowing cash from the cheapest possible source.

On occasions, the STO may be positive of cash at the custodian, as a result of one or many sales settling (with a greater cash value than purchases).

Funding is a commonly used term to describe the financing of investments through the borrowing of cash on a secured and/or unsecured basis, and the act of minimising the cost of borrowing cash, and maximising the benefit of lending cash.

The subject of funding is one of the more challenging operational aspects of the securities industry. In order to express the concepts initially, the example of a single purchase of securities and its associated cash will be used to convey the impact on funding, and the ...

Get Securities Operations: A Guide to Trade and Position Management now with the O’Reilly learning platform.

O’Reilly members experience books, live events, courses curated by job role, and more from O’Reilly and nearly 200 top publishers.