15

Transaction Reporting

15.1 INTRODUCTION

Within each marketplace, a regulatory environment exists in order to ensure that the market operates in a fair and orderly manner. This encompasses a number of facets of operation relating to stock exchange/market members, including STOs, such as:

- transaction reporting

- trading rule breaches

- position taking disproportionate to the member's financial position (also known as capital adequacy).

The rules and regulations set up by marketplaces are designed to provide an efficient market environment based upon investor protection, the interests of its members and guarding the reputation of the marketplace.

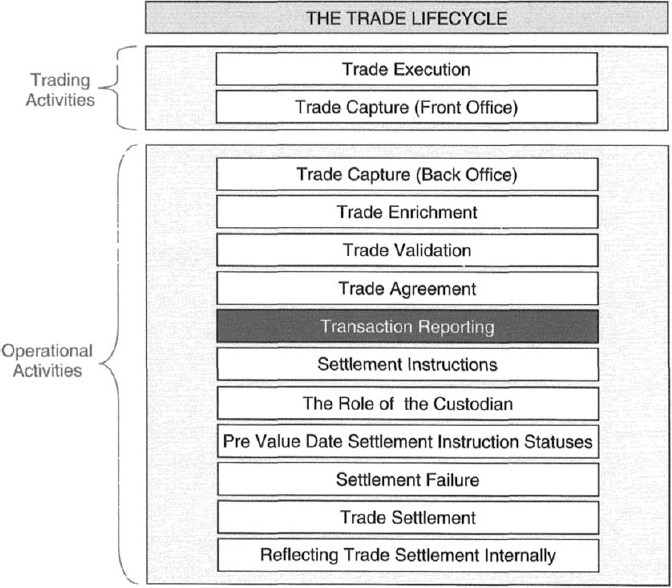

This chapter focuses on transaction reporting, as it is a component of the trade lifecycle that stock exchange/market members must comply with and is an essential part of being a member firm.

15.2 PURPOSE OF TRANSACTION REPORTING

Following execution of a trade, stock exchange/market members are normally required to report to the appropriate regulator the details of each transaction undertaken, within a prestated timeframe from the time of trade execution. This information allows the regulator to assess and supervise the business being transacted by individual companies within the marketplace. This activity is commonly referred to as supervision or surveillance within the regulatory environment.

Marketplaces endeavour to be regarded as fair ...

Get Securities Operations: A Guide to Trade and Position Management now with the O’Reilly learning platform.

O’Reilly members experience books, live events, courses curated by job role, and more from O’Reilly and nearly 200 top publishers.