11

Trade Execution and Capture

11.1 INTRODUCTION

Trading began in meeting points such as coffee shops; it became more formalised when stock exchanges were formed, where trading would be conducted on a face-to-face basis. For some marketplaces that have been formed in more recent times, telephone has been the sole medium for conducting trading. Today, some face-to-face marketplaces still exist, others have become mainly telephone based, and some marketplaces operate on an electronic basis.

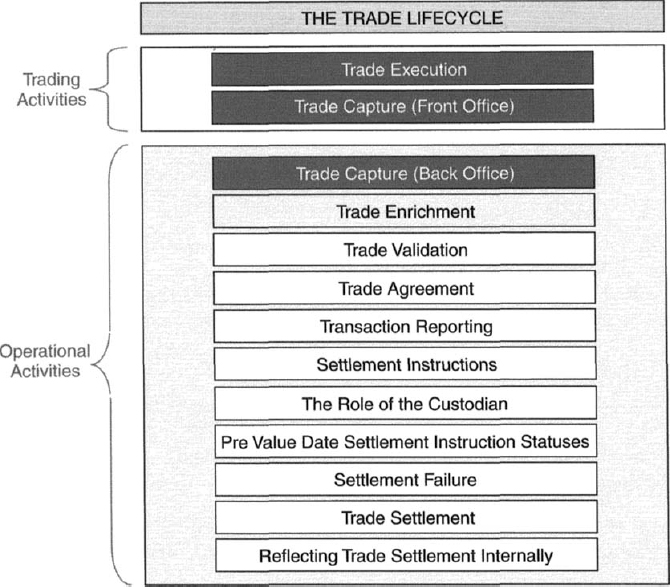

This chapter describes:

- the flow and management of orders from clients

- trade execution, and the components that form a trade

- trade capture within the front office

- trade capture within the back office

in order to convey the sequential steps involved in trade execution and capture.

11.2 ORDERS FROM INSTITUTIONAL CLIENTS

An order is a request to buy or sell securities, given by an investor (such as an institutional client) to an STO, or to an agent for investors. Usually, some (but not all) of the trades executed by STOs are originated by orders from its institutional clients.

11.2.1 Order Features

Orders contain a number of standard features, such as the request to:

- buy or sell

- a specific quantity of

- a specific security

and will contain a number of features that are relevant to the price, including:

- Limit—a price is specified, meaning

- when buying, pay no more than the stated price

- when selling, ...

Get Securities Operations: A Guide to Trade and Position Management now with the O’Reilly learning platform.

O’Reilly members experience books, live events, courses curated by job role, and more from O’Reilly and nearly 200 top publishers.