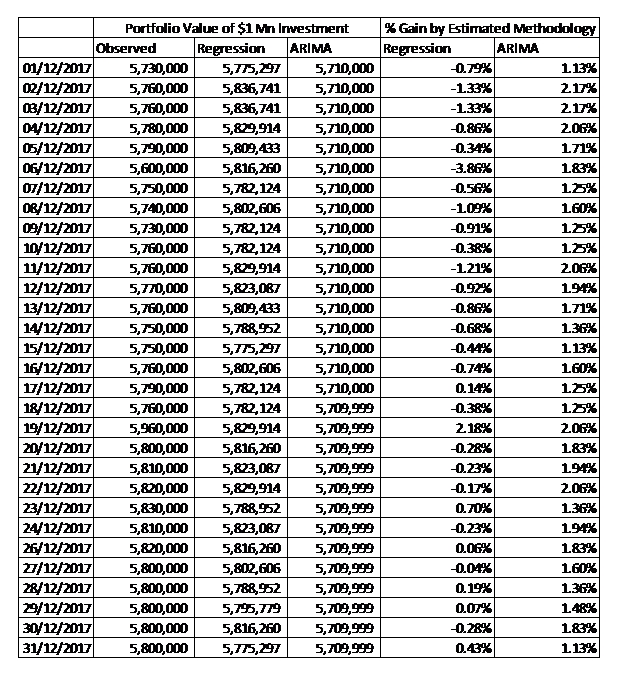

We have observed that the regression model seems to be doing a better forecasting job. When integrating the model with our business, we need to further evaluate the impact of selecting a particular model:

We now have the actual gain or loss position of the portfolio of $1 million that we would have held for the stock in December, 2017. The average gain, based on the regression and ARIMA estimate, would be -0.47% and +1.64%, respectively. This shows that for the investor, the positive news will be when the ARIMA model would have been the basis for investment. However, what would ...