CHAPTER 5High‐Frequency Trading in Your Backyard

- —What do experienced bond traders and typists have in common?

- —Computers ate their lunch.

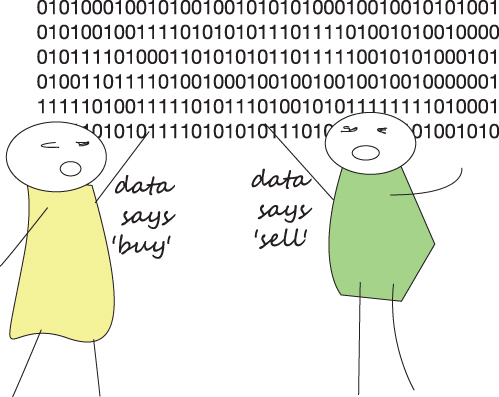

High‐frequency trading (HFT) is another fintech innovation capitalizing on plunging costs of technology. When programmed correctly, HFT software has built‐in advantages over manual trading. Computers seldom become ill, are hardly emotional, and make, in short, superior cool‐headed traders who stick to the script and don't panic.

Of course, some recent research purports that some people, especially those attuned to their intuitive or biological responses, can outperform machines. Well, good for those few! By and large, however, human traders tend to be a superstitious, irrational lot prone to, well, human behavior, and no match for their steely automated trading brethren.

Perhaps one of the largest advantages of machines, however, is not that they can contain their nonexistent feelings, but in their information processing power. Humans have a finite ability to process data. We may, possibly, be able to stare at some 16 screens all at once, but our eyes can still only process 24 distinct visual frames per second. Should the information update faster than that, we simply miss it. Computers, on the other hand, can process unlimited volumes of data at the speed of light.

Even more importantly, following just a few news sources and several ...

Get Real-Time Risk now with the O’Reilly learning platform.

O’Reilly members experience books, live events, courses curated by job role, and more from O’Reilly and nearly 200 top publishers.