Part III

Home Finances

In this part . . .

![]() Expand your use of Quicken to monitor credit cards, debit cards, cash accounts, and even online accounts such as PayPal so you know about all your cash flows.

Expand your use of Quicken to monitor credit cards, debit cards, cash accounts, and even online accounts such as PayPal so you know about all your cash flows.

![]() Track your borrowing for items such as vehicles and real estate to manage your debts and minimize interest costs.

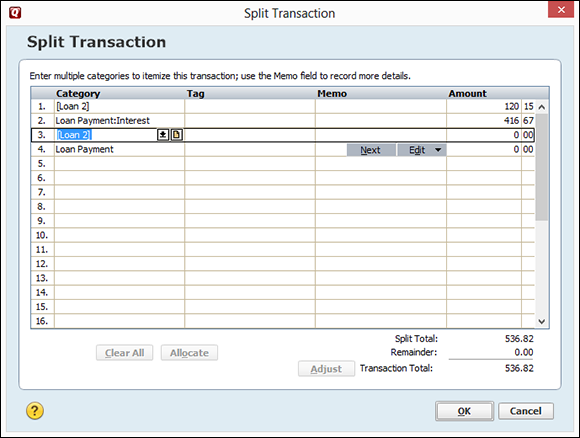

Track your borrowing for items such as vehicles and real estate to manage your debts and minimize interest costs.

![]() Minimize your tax burden by appropriately managing your tax-deferred investments in IRAs, 401(k)s, and similar investment accounts.

Minimize your tax burden by appropriately managing your tax-deferred investments in IRAs, 401(k)s, and similar investment accounts.

![]() Improve your investment performance by keeping better records of investment profits and losses, returns, and asset allocations.

Improve your investment performance by keeping better records of investment profits and losses, returns, and asset allocations.

To learn to simplify your taxes by carefully structuring your investments across taxable and tax-deferred accounts, visit

To learn to simplify your taxes by carefully structuring your investments across taxable and tax-deferred accounts, visit