Repaying a Loan

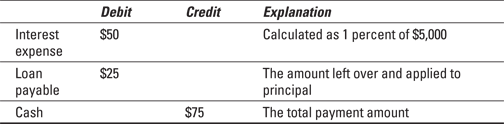

To record loan payments, you need to split each payment between two accounts: the interest expense account and the loan payable account.

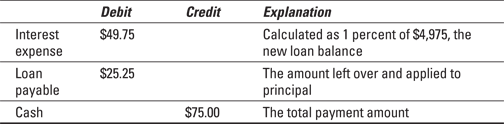

The next month, of course, the loan balance is slightly less (because you made a $25 dent in the loan principal, as shown in the preceding loan payment journal entry). The following journal entry records the second month’s loan payment:

Get QuickBooks 2013 For Dummies now with the O’Reilly learning platform.

O’Reilly members experience books, live events, courses curated by job role, and more from O’Reilly and nearly 200 top publishers.

Get the lender to provide you an amortization schedule that shows the breakdown of each payment into interest expense and loan principal reduction. If this doesn’t work, choose Banking⇒Loan Manager. QuickBooks displays the Loan Manager window. If you click the Add a Loan button, QuickBooks collects a bit of information about the loan terms and builds an amortization schedule for you. Note, too, that you can tell QuickBooks to remind you of upcoming loan payments and even to schedule the payments.

Get the lender to provide you an amortization schedule that shows the breakdown of each payment into interest expense and loan principal reduction. If this doesn’t work, choose Banking⇒Loan Manager. QuickBooks displays the Loan Manager window. If you click the Add a Loan button, QuickBooks collects a bit of information about the loan terms and builds an amortization schedule for you. Note, too, that you can tell QuickBooks to remind you of upcoming loan payments and even to schedule the payments.