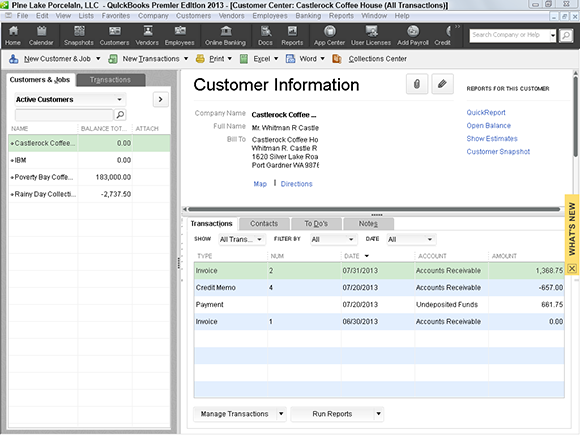

Figure 5-9: The Customer Center.

Improving Your Cash Inflow

I’m not going to provide a lengthy discussion of how to go about collecting cash from your customers. I do, however, want to quickly tell you about a couple other details. You need to know how to monitor what your customers owe you and how to assess finance charges. Don’t worry, though. I explain these two things as briefly as I can.

Tracking what your customers owe

You can track what a customer owes in a couple ways. Probably the simplest method is to display the Customer Center by choosing Customer⇒Customer Center. Next, select the customer from the Customers & Jobs list (which appears along the left edge of the window). QuickBooks whips up a page that lists transactions for the customer. It also shows the customer’s contact information. Figure 5-9 shows the Customer Center information for a customer.

You also should be aware that QuickBooks provides several nifty accounts receivable (A/R) reports. You get to these reports by clicking the Reports icon and choosing Customers & Receivables. Or you can choose Reports⇒Customers & Receivables. QuickBooks then displays a submenu of about a half-dozen reports that describe how much money customers owe you. Some reports, for example, organize open invoices into different groups based on how old the invoices are. (These reports are called agings.) Some reports summarize only ...

Get QuickBooks 2013 For Dummies now with the O’Reilly learning platform.

O’Reilly members experience books, live events, courses curated by job role, and more from O’Reilly and nearly 200 top publishers.