The First “What Happens If . . . ?” Formula

One curiosity about small businesses is that small changes in revenue or income can have huge impacts on profits. A retailer who cruises along at $200,000 in revenue and struggles to live on $30,000 per year never realizes that boosting the sales volume by 20 percent to $250,000 might increase profits by 200 percent to $60,000.

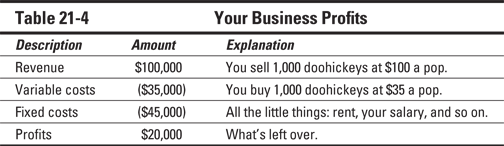

Accountants like to whip up little tables that describe these sorts of things, so Table 21-4 gives the current story on your imaginary business.

Table 21-4 shows the current situation. Suppose that you want to know what will happen to your profits if ...

Get QuickBooks 2013 For Dummies now with the O’Reilly learning platform.

O’Reilly members experience books, live events, courses curated by job role, and more from O’Reilly and nearly 200 top publishers.

The following example shows how this point works and provides a secret formula. For starters, say that you currently generate $100,000 yearly in revenue and make $20,000 per year in profits. The revenue per item sold is $100, and the variable cost per item sold is $35. (In this case, the fixed costs happen to be $45,000 per year, but that figure isn’t all that important to the analysis.)

The following example shows how this point works and provides a secret formula. For starters, say that you currently generate $100,000 yearly in revenue and make $20,000 per year in profits. The revenue per item sold is $100, and the variable cost per item sold is $35. (In this case, the fixed costs happen to be $45,000 per year, but that figure isn’t all that important to the analysis.)