Whether you build houses, sell gardening tools, or tell fortunes on the Internet, you’ll probably use items in QuickBooks. In QuickBooks, items are the products and services you sell. But to the program, things like subtotals, discounts, and sales tax are items, too. Nothing appears in the body of a QuickBooks sales form (such as an invoice) unless it’s an item.

Put another way, when you want to create invoices (Chapter 8) in QuickBooks, you need customers and items to do so. So now that you’ve got your customers and your Chart of Accounts set up, it’s time to dive into items.

This chapter begins by helping you decide whether you need items at all. But if your organization is like most and uses business forms such as invoices, sales receipts, and so on, you’ll read the rest of the chapter to learn how to create, name, edit, and manage them.

For your day-to-day work with QuickBooks, items save time and increase consistency. Here’s the deal. When you create an item, you specify its characteristics. The fields you fill in include what the item is, how much you pay for it, how much you sell it for, and the accounts to which you post the corresponding income and expense. For example, the bookkeeping service you provide might cost $75 an hour and you want the income to show up in your Financial Services income account. Then, when you add an item to a sales form, QuickBooks fills in the fields on the form with the information you stored in the item.

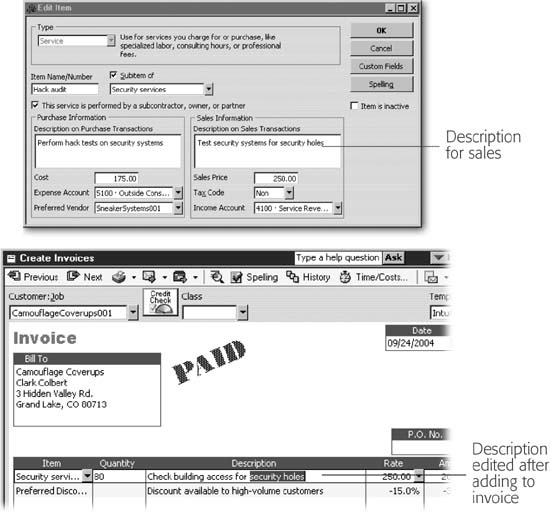

You can work out which accounts to assign items to on your own or with your accountant (a good idea if you’re new to bookkeeping), and then specify the accounts in your items. QuickBooks remembers these assignments from then on, as illustrated in Figure 4-1.

Figure 4-1. Top: You’d be bound to make mistakes if you had to enter item details each time you added an entry to an invoice. By setting up an item with its associated details, you can make sure that you use the same information on sales forms each time you sell that item. Bottom: When the inevitable exception to the rule arises, you can edit the item fields that QuickBooks fills in. You can select portions of the text for replacement or click in the text to position the cursor.

When it’s time to analyze how your business is doing, items shine. QuickBooks has built-in reports based on items, which show the dollar value of sales or the number of units of inventory you’ve sold. To learn how to use inventory reports, see page 402. For other item-based reports, read Chapter 19.

Bottom line: without items, you can’t create any type of sales form in QuickBooks, and that includes invoices, statements, sales receipts, credit memos, and estimates. Conversely, if you don’t use sales forms, you don’t need items. Few organizations operate without sales forms, but here are a few examples:

Old Stuff Antiques sells antiques on consignment. Kate, the owner, doesn’t pay for the pieces; she just displays them in her store. When she sells a consignment item, she writes paper sales receipts. When she receives her cut from the seller, she deposits the money in her checking account.

Tony owns a tattoo parlor specializing in gang insignias. He doesn’t care how many tattoos he creates and, for safety’s sake, he doesn’t want to know his customers’ names. All Tony does is deposit the cash he receives upon completing each masterpiece.

Dominic keeps the books for his charity for icebergless penguins. The charity accepts donations of money and fish, and doesn’t sell any products or perform services to earn additional income. He deposits the monetary donations into the charity’s checking account and enters the checking account deposit in QuickBooks. Dominic does keep track of the donors and fish inventory in a spreadsheet.

If your business is based solely on selling services, you can skip this section entirely. But if you sell products at all, you can handle them in two ways: by stocking and tracking inventory or by buying and reselling it on a customer-by-customer basis. The system you use affects the types of items you create in QuickBooks. When you use QuickBooks’ inventory feature, the program keeps track of how many products you have on hand as you purchase and sell them to customers. When you purchase products specifically for customers, you still need items, but there’s no need to track the quantity on hand. In this case, you can create non-inventory part items, which you’ll learn more about shortly.

For example, general contractors rarely work on the same type of project twice, so they usually purchase the materials they need for a job and charge the customer for those materials. Because general contractors don’t keep materials in stock, they don’t have to track inventory and can use Non-inventory Part items. On the other hand, specialized contractors such as plumbers install the same kinds of pipes and fittings over and over. These contractors often purchase parts and store them in a warehouse, selling them to their customers as they perform jobs. These warehoused parts should be set up as Inventory Part items in QuickBooks.

Tracking inventory requires more effort than buying just the materials you need. Use the following questions to determine whether or not your business should track inventory:

Do you keep products in stock to resell to customers? If your company stocks faux pony bar stools to resell to customers, those bar stools are inventory. By tracking inventory, you know how many units you have on hand, how much they’re worth, and how much money you made on the ones you sold.

The faux pony mouse pads you keep in the storage closet for your employees are business supplies. Most companies don’t want the overhead of tracking inventory for supplies they consume in the course of business.

Do you want to know when to reorder products so you don’t run out? If you sell the same items over and over, keeping your shelves stocked means more sales. QuickBooks can remind you when it’s time to reorder a product.

Do you purchase products specifically for jobs or customers? If you special order products for customers or purchase products for a specific job, you don’t need to track inventory. After you deliver the special order or complete the job, your customer has taken and paid for products and you must account only for the income and expense you incurred.

Your business model might dictate that you track inventory. However, QuickBooks’ inventory-tracking feature has some limitations. For example, it lets you store up to 14,500 items, and then you’re stuck. If you answer yes to any of the following questions, QuickBooks isn’t the program to use to handle the products you sell:

Do you sell products that are unique? In the business world, tracking inventory is meant for businesses that sell commodity products, such as electronic equipment, and stock numerous units of each product. If you sell unique items, such as fine art or compromising Polaroid photos, you’d eventually use up the 14,500 items that QuickBooks can store. For unique items, consider using a spreadsheet to track the products you have on hand. When you sell your unique handicrafts, you can record your sales in QuickBooks using items that aren’t unique. For example, use an item called Oil Painting on the sales receipts for the oils you sell.

Do you manufacture the products you sell out of raw materials? QuickBooks inventory can’t follow materials as they wend through a manufacturing process, or track inventory in various stages of completion.

Note

QuickBooks Premier and Enterprise editions can track inventory for products that require light assembly. For instance, if you create Wines from Around the World gift baskets using the wine bottles in your store, you can build an Inventory Assembly item out of wine and basket Inventory items.

Do you sell on consignment or rent your inventory? When you sell on consignment, you don’t purchase the products you sell. If you want to keep track of your consignment items, create a separate spreadsheet or database. Similarly, if you rent or lease your inventory, you receive income for not selling your products. In this case, you can show the value of your inventory as an asset in QuickBooks, but you don’t need Inventory items, because the number of items you have on hand doesn’t change very often.

Do you value your inventory by a method other than average cost? QuickBooks calculates inventory value by average cost. If you want to use other methods, like last in, first out (LIFO) or first in, first out (FIFO), you can export inventory data to a spreadsheet and calculate inventory cost outside of QuickBooks (page 518).

Do you use a point-of-sale system to track inventory? Point-of-sale inventory systems blow QuickBooks inventory tracking out of the water. If you use one of these systems, forego QuickBooks’ inventory feature. You can periodically update your QuickBooks file with the value of your inventory from the point-of-sale system.

Tip

You can still use QuickBooks, even if you are less than impressed by its inventory capabilities. For example, if you perform light manufacturing, you can track the value of your manufactured inventory in a database or other program. Periodically, you can add journal entries to QuickBooks to show the value of in-progress and completed inventory.

Ten types of items are all it takes to satisfy most of the sales needs of small businesses and nonprofit organizations. Learning what each type of item does seems like an unnecessary delay if you’re anxious to start keeping books, but choosing the wrong type of item can lead to a dead end that only a major overhaul can fix. This section explains the ten item types. Avoid a six-Advil headache, and read it before you dive in.

Note

You can change only Non-inventory Part and Other Charge items into different types of items. Moreover, these two types convert only into Service, Non-inventory Part, Inventory Part, or Other Charge items. Because of this limitation, be careful when you change item types. If you make the wrong choice, you might not be able to change the item back.

Services are less tangible things that you sell, like time or the output of your brain. For example, you might sell consulting services, Internet connection time, magazine articles, or Tarot card readings. In construction, services represent phases of construction, which makes it easy to bill customers based on progress and compare actual values to estimates. In some companies, such as law practices, the partners get paid based on the hours they bill, so the partners’ compensation is an expense associated directly with the income.

The mighty Service item single-handedly manages all types of services, whether you charge by the hour or by the service, associated expenses or not.

Products you sell to customers fall into three categories: products you keep in inventory, products that you special order, and products you assemble. QuickBooks can handle inventory as long as your company passes the tests on page 77. Likewise, products purchased specifically for customers or jobs are no problem. As explained on page 78, QuickBooks can handle only lightly assembled products like gift baskets or gizmos made from widgets—and you’ll need a QuickBooks Premier Edition to do even that.

In QuickBooks Pro, choose one of these two item types for the products you sell:

Inventory Part. Use this type of item for products you purchase and keep in stock for resale. Retailers and wholesalers are the obvious examples of inventory-based businesses, but other types of businesses track inventory, too. You can create Inventory Part items only if you turn on the inventory feature as described on page 145. With inventory parts, you can track how many you have, how much they’re worth, and when you should reorder.

Non-inventory Part. If you purchase products specifically for a job or a customer and don’t track how many products you have on hand, use Non-inventory Part items. Unlike an Inventory Part item, the Non-inventory Part item has at most two account fields: one for income and the other for expense.

Tip

Many companies don’t bother with purchase orders, which are forms that record what you order from a vendor, to buy office supplies. But if you want to track whether you receive the supplies you bought, you can create purchase orders for them (page 273). Then use Non-inventory Part items for supplies you add to purchase orders but don’t track as inventory.

If a line on a sales form isn’t a service or a product, look to one of the following items:

Other Charge. The Other Charge item is aptly named, because you use it for any charge that isn’t quite a service or a part—for instance, shipping charges, finance charges, or the charges for bounced checks. Other Charge items can be percentages or fixed amounts. For example, you can set up shipping charges as the actual cost for shipping or you can estimate shipping as a percentage of the product cost.

Tip

If a customer holds back a percentage of your charges until you complete the job satisfactorily, create an Other Charge item for the retainer (that is, the portion of your invoice that the customer doesn’t pay initially). In this case, enter a negative percentage so QuickBooks deducts the retainer from the invoice. When your customer approves the job, create an invoice using another Other Charge item, called Retention, to charge the customer for the amount they withheld.

Subtotal. You’ll need Subtotal items if you charge sales tax on the products you sell or discount only some of the items on a sales form. The Subtotal item adds up all the preceding entries up to the last subtotal item, which means you can have more than one subtotal on an invoice.

For example, you can use one Subtotal item to add up the services you sell before applying a preferred customer product discount and a second Subtotal for product sales when you have to calculate sales tax.

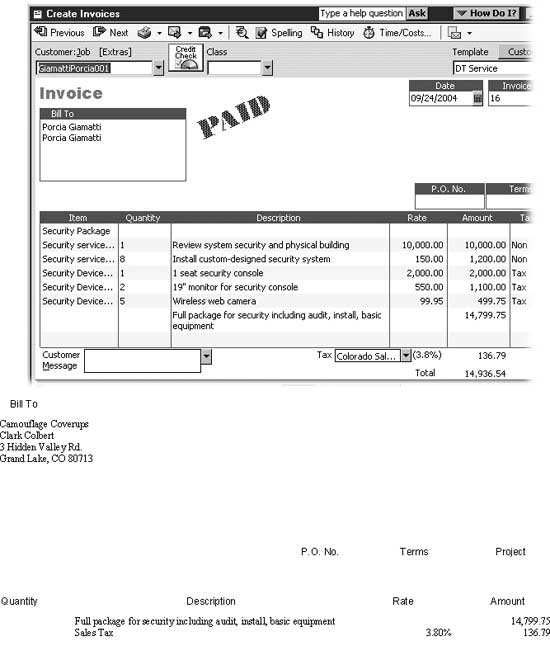

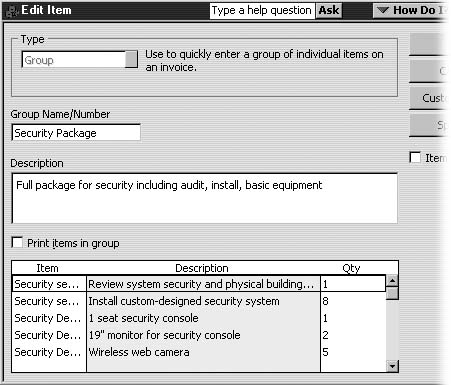

Group.The Group item is a great timesaver, and it’s indispensable if you have a tendency to forget things. Create a Group item that contains items that always appear together, such as each service you provide for a landscaping job. As demonstrated in Figure 4-2, you can show or suppress the individual items that a Group item contains.

Discount. As a bookkeeper, you know that a discount is an amount you deduct from the standard price you charge. Volume discounts, customer loyalty discounts, or sale discounts are examples, and the Discount item in QuickBooks calculates deductions like these. By using both Subtotal and Discount items, you can apply discounts to some or all of the charges on a sales form.

Figure 4-2. Top: When you add a Group item to an invoice, QuickBooks replaces that one item with all the individual items along with their prices, descriptions, and whatever else you’ve defined. To show these items on the invoice, turn on the “Print items in group” checkbox. Bottom: For fixed-price invoices , which you use when you charge the customer a fixed amount regardless of how much or little it costs you to deliver, you don’t want to show the underlying prices for each item you deliver. When you create a Group item and turn off the “Print items in group” checkbox, you still see all the individual items in the Create Invoices dialog box, but the invoice you generate to send to the customer shows only the Group item itself along with the total cost for all the items in the Group.

Note

Early payment discounts don’t appear on a sales form, because you won’t know that a customer pays early until long after the sales form is complete. You apply early payment discounts in the Receive Payments dialog box, described on page 240.

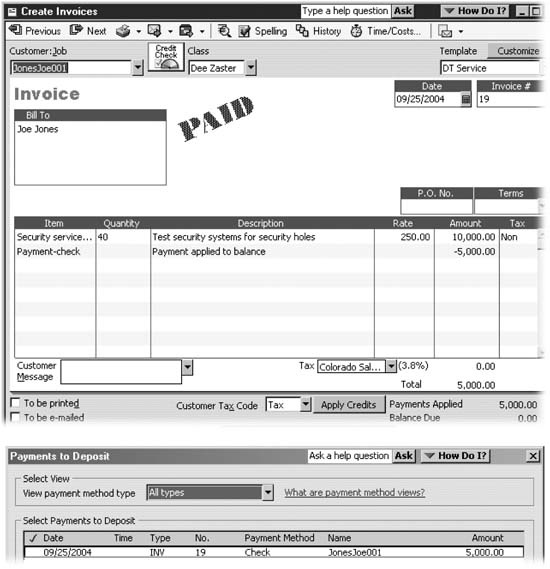

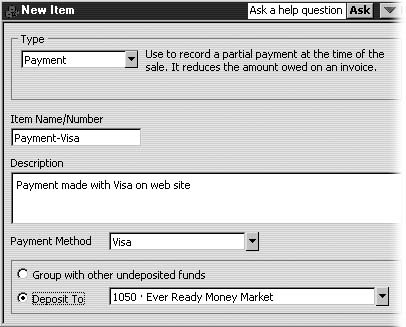

Payment. When your customers send you payments, you can log them into your QuickBooks file using the Receive Payments command. If you’re in the middle of creating invoices when the checks arrive, it’s easier to log those payments by adding a Payment item to the customers’ sales forms. A Payment item does more than reduce the amount owed on the invoice, as shown in Figure 4-3.

Figure 4-3. Top: A Payment item reduces the balance on an invoice by the amount the customer paid. Bottom: A Payment item also executes the equivalent of a Receive Payments command. A Payment item assigns the payment method that the customer used and deposits the funds into a bank account, or groups the payment with other undeposited funds.

Sales Tax. If you sell products and must charge sales tax to satisfy your state or local tax authority, create Sales Tax items for each tax levied. For example, suppose local and state taxes apply to products you sell in your store, but for customers to whom you ship goods in other states, sales taxes for those other states apply. You can create separate Sales Tax items for your local tax and the state sales taxes for each state in which you do business. See page 298 to learn how to activate the sales tax feature.

Sales Tax Group. Like the Group item, the Sales Tax Group item applies several Sales Tax items at once, which speeds up adding Sales Tax items to invoices when you sell products in a location that levies sales taxes exuberantly.

Setting up items in QuickBooks is a lot like shopping at the grocery store. If you need only a few things, you can shop without a list. Similarly, if you use just a few QuickBooks items, you don’t need to write it all out. But if you use dozens or even hundreds of items, planning your item list can save you from experiencing all sorts of unpleasant emotions.

If you jumped feet first into this section, now’s the time to read “Should You Track Inventory with Items?” on page 77 and “The QuickBooks Item Types” on page 79. Those sections help you with your first decision: whether to use Service, Inventory Part, and Non-inventory Part items. Read on to learn the other issues you should consider before creating your items in QuickBooks.

Conservation can be as important with QuickBooks items as it is for matter and the environment. QuickBooks Pro and premier can hold no more than 14,500 items—a problem only if you sell unique products, such as antiques, or products that change frequently, such as the current clothing style for teenagers. Once you use an item in a transaction, you can’t delete that item, so your item list could fill up with items you no longer use (see page 99).

By planning up front how specific your items are, you can keep your QuickBooks list lean with generic items. For instance, a generic item such as Top can represent a girl’s black Goth t-shirt in the winter of 2002 or a white poplin button-down shirt in the summer of 2003.

Generic items have their limitations, though, so use them only if necessary. First, you can’t track inventory properly when you use generic items. QuickBooks might show that you have 100 tops in stock, but that doesn’t help when your customers are clamoring for white button-downs and you have 97 black Goth t-shirts. In addition, the information you store with a generic item won’t match the specifics of each product you sell. So when you add generic items to an invoice or sales form, you’ll have to edit a few fields, such as description or price.

With item names, brevity and recognizability are equally desirable characteristics. On the one hand, short names are easier to type and manage, but they can be unintelligible. Longer names are harder to type and manage but easier to read. Decide ahead of time which type of naming you prefer and stick with it as you create items.

QuickBooks encourages brevity by allowing no more than 31 characters in an item name. If you sell only a handful of services, you can name your items as you refer to them when you’re talking. For a tree services company, names like cut, limb, trim, chip, and haul work just fine. If your item list runs in the hundreds or thousands, some planning is in order. Here are some factors to consider when naming your items:

Abbreviation. If you have to compress a great deal of information into an item name, you’ll have to abbreviate. For example, suppose you want to convey all the things you do when you install a carpet, including installing tack strips, padding, and carpet, trimming carpet, vacuuming, and hauling waste. That’s more than the 31 characters you have to work with. Poetic won’t describe it, but something like “inst tkst,pad,cpt,trim,vac,haul” says it all in very few characters.

Aliases. Create a pseudonym to represent the item. For the carpet job, “Standard install” can represent the installation with vacuuming and hauling waste, while “Deluxe install” includes the standard installation plus moving and replacing furniture. You can include the detail in the item description.

Sort order. QuickBooks lists the items you create in the Item List first by item type and then in alphabetical order. If you want your items to appear in some logical order on drop-down lists (for instance, in an invoice item table), pay attention to the order of characteristics in your item names. Other service items beginning with the intervening letters of the alphabet would separate “Deluxe install” and “Standard install.” If you name your installation items “Install, deluxe” and “Install, standard,” they’ll show up one after the other in your item list.

Tip

Construction companies in particular can forego long hours of item data entry with a nifty trick using third-party estimating programs. Construction estimating programs usually include thousands of entries for standard construction services and products. If you build an estimate with a program that integrates with QuickBooks, you can import that estimate into QuickBooks and then sit back and watch as it automatically adds all the items in the estimate to your item list. To find such programs that integrate with QuickBooks, go to http://marketplace.intuit.com and then click the Construction link.

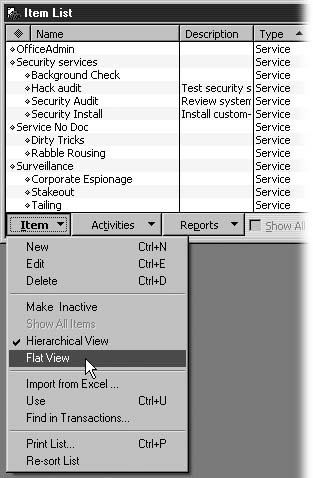

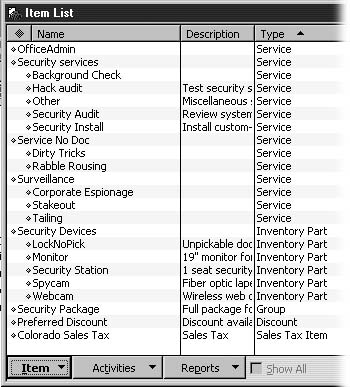

If you keep all your personal papers in one big stack, you probably have a hard time finding everything from birth certificates to tax forms to bills and receipts. If you’ve got one big list of items in QuickBooks, you’re in no better shape. To locate items more easily, consider designing a hierarchy of higher-level items (parents) and one or more levels of subitems, as illustrated in Figure 4-4.

For example, a landscaping business might create top-level items for trees, shrubbery, cacti, and flower bulbs. Within the tree top-level item, the landscaper might create items for each species: maple, oak, elm, sycamore, and dogwood. Additional levels of subitems can represent categories such as size (seedling, established, and mature, for example).

Figure 4-4. The Hierarchical view indents subitems in the item list, making it easy to differentiate the items that you use to structure the list from the items you actually sell. If you work with long lists of subitems, the parent might scroll off the screen. To keep the hierarchy of items visible at all times, in the menu bar at the bottom of the window, click Item and then choose Flat View. QuickBooks uses colons to separate the names for each level of item and subitem.

For most product sales in most areas, you have to keep track of the sales taxes you collect and then send them to the appropriate tax agencies. Labor is usually not taxable, whereas products usually are. Creating separate items for labor and materials makes it easy to apply sales tax to the appropriate items or subtotals on your invoices. Separating the items you’ve identified into taxable and non-taxable categories can help you decide whether you need one or more items for a particular service or product.

Items include a Tax Code field, so you can designate each item as taxable or non-taxable. If you look carefully at the top invoice in Figure 4-2, you’ll notice “Non” or “Tax” to the right of some of the amounts, which indicates non-taxable and taxable items, respectively. QuickBooks applies the sales tax only to taxable items to calculate the sales Taxes, and tax on the invoice.

Once you’ve decided how to name and organize your items, you’re ready to get down to business creating items. By planning your item list before you create individual items, you won’t waste time editing and reworking existing items to fit your new naming scheme.

The best time to create items is after you’ve created your accounts, but before you start billing customers. Each item links to an account in your Chart of Accounts, so creating items goes quicker if you don’t have to stop to create an account as well. Similarly, you can create items while you’re in the midst of creating an invoice, but you’ll find creating items goes much faster when you create one item after the other. The amount of time it takes to create items depends on how many items you need. If you sell only a few services, a few minutes should be sufficient. On the other hand, construction companies that need thousands of items often forego hours of data entry by importing items from third-party programs (page 515).

Each type of item has its own assortment of fields, but the overall procedure for creating items is the same for every type. With the following procedure under your belt, you’ll find that you can create many of your items without further instruction. If you do need help with fields for a specific type of item, read the sections that follow to learn what each field does.

Figure 4-5. Within each type of item, QuickBooks lists items in alphabetical order. You can change the sort order of the Item List by clicking a column heading. If you click it again, QuickBooks toggles the list order between ascending and descending order. To return the list to sort by item type, click the diamond to the left of the column headings.

Before you can create items, you have to open the Item List window. Choose Lists→Item List or, in the icon bar, click Item.

When you first display the item list, QuickBooks sorts entries by item type. The sort order for the item types isn’t alphabetical but in the order that item types appear in the Type drop-down list. You can change the sort order of the list as shown in Figure Figure 4-5.

Open the New Item dialog box by pressing Ctrl+N. Alternatively, on the menu bar at the bottom of the window, click Item, and then choose New.

QuickBooks opens the New Item dialog box and highlights the Service item type in the Type drop-down list.

If you want to create a Service item, just press Tab to proceed to naming the item. If you want to create any other type of item, choose the type of item in the Type drop-down list.

In the Item Name/Number box, type a unique identifier for the item.

For example, if you opt for long and meaningful names, you might type “Install tack strips, carpet, clean, and haul waste.” For short names, you might type “Inst Carpt.”

To make this item a subitem of another item, as shown in Figure 4-5, turn on the “Subitem of " checkbox.

You can create the parent item in the midst of creating a subitem, but creating the parent first puts much less strain on your brain. When the parent item already exists, simply choose it from the “Subitem of " drop-down list. To create the parent while creating the subitem, choose <Add New> on the “Subitem of " drop-down list and jump to step 3 to begin the parent creation process. Subitems and parents must be the same type.

You have to assign an account to every item, whether it’s a parent or not. However, you need Rate or Price values only if you plan to use items on invoices or other sales forms.

If you turned on the “Subitem of " checkbox, in the drop-down list, choose the item that you want to act as the parent.

Complete the other fields as described in the sections that follow (Service Fields, Inventory Part Fields, and so on) for the type of item you’re creating.

Tip

When you create an item, you can enter information that QuickBooks will later use to fill in fields on sales forms. For example, you can type in the sales price, and QuickBooks uses that sales price on an invoice when you sell some units. If the sales price changes each time, simply leave the item’s Sales Price field at zero. In this case, QuickBooks doesn’t fill in the price, so you can type the value each time you sell the item. Even if you set up a value for an item, you can overwrite it whenever you use the item on a sales form.

When you have many items to create, simply click Next to save the current item and begin another. If you want to save the item you just created and close the New Item dialog box, click OK.

If you’ve made mistakes in almost every field or need more information before you can complete an item, click Cancel to throw away the current item and close the New Item dialog box.

Suppose you offer a telephone answering service. You earn income when your customers pay you for the service. You pay salaries to the people who answer the phones, regardless of whether you have two service contracts or twenty. For this business, you earn income from selling your service, but your costs don’t link to the income from specific customers or jobs.

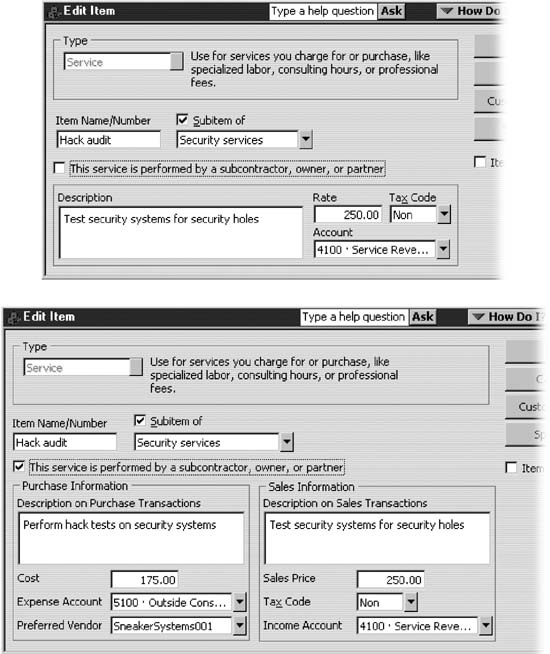

Services that you farm out to a subcontractor work differently. For example, if you offer a 900 number for gardening advice, you might have a group of freelancers who field the calls and whom you pay only for their time on the phone. You still earn income for the service you sell, but you also have to pay the subcontractors to do the work. The subcontractors’ cost relates to the income for that service. QuickBooks displays different fields depending on whether a service has costs associated with income.

Here’s how the Service fields work:

“This service is performed by a subcontractor, owner, or partner” checkbox. As shown in Figure 4-6, this checkbox is the key to displaying the fields you need when you purchase services from someone else.

Description on Purchase Transactions. Type the description that you want to appear on the purchase orders you issue to subcontractors.

Cost. Enter what you pay for the service, which can be an hourly rate or a flat fee. For example, if a partner performs the service and receives $100 for each hour of work, type 100 in this field. If the cost varies, type 0 in the Cost field. You can then enter the actual cost when you create a purchase order.

Expense Account. Choose the account to which you want to post what you pay for the service. If a subcontractor does the work, choose an expense account for subcontractor or outside consultants’ fees. If a partner or owner performs the work, choose an expense account for job-related costs.

Note

QuickBooks multiplies the cost and sales prices by the quantities you add to sales forms. Be sure to define the cost and sales price in the same units, so QuickBooks calculates your income and expenses correctly.

Figure 4-6. Top: If a service doesn’t have costs directly associated with it, you define only the rate, the tax code, and the income account for the service. Bottom: If subcontractors, owners, or partners perform the service and get paid for their work, a Service item must contain information for both the sales and purchase transactions. QuickBooks uses the information in the Purchase Information section of the Create Item or Edit Item dialog boxes to fill out purchase orders or track owners’ earned compensation. The information in the Sales Information section goes into fields on invoices.

Preferred Vendor. If you choose a vendor in this drop-down list, QuickBooks selects the preferred vendor for a purchase order when you add this Service item. This is helpful only if you almost always use the same vendor for this service and you add the service item to a purchase order before you choose the vendor.

Description on Sales Transactions. If you create a Service item without associated costs, type a detailed description for the service in this box. This description appears on invoices and sales forms, so use terms your customers can understand.

For items with associated costs, QuickBooks copies the text from the Description on Purchase Transactions box to the Description on Sales Transactions box. However, if your vendors use technical jargon that your customers wouldn’t recognize, you can change the text in the Description on Sales Transactions box to something more meaningful.

Sales Price. Type how much you charge your customers for the service. You can enter a flat fee or a charge per unit of time. For example, you might charge $9.95 for unlimited gardening advice per call, but Intuit telephone support charges by the minute.

When you add the item to an invoice, QuickBooks multiplies the quantity by the sales price to calculate the total charge. If the cost varies, type 0 in the Sales Price field. You can then enter the price when you create an invoice or other sales form.

Note

For all types of items, the Tax Code field appears only if you’ve turned on the sales tax feature, as described on page 157.

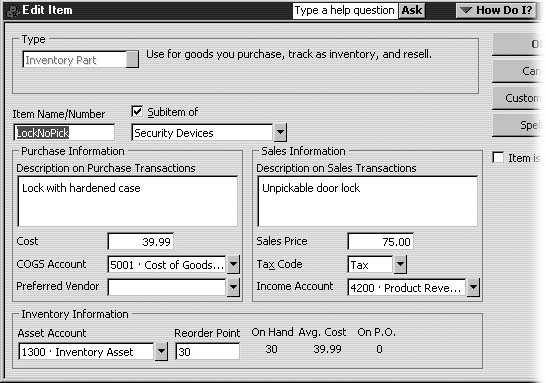

As described in the “Following the Inventory Money Trail” box on page 80, dollars move between accounts as you buy and sell inventory. Here’s how you use the fields for an Inventory Part item (shown in Figure 4-7) to define your company’s inventory money trail and, at the same time, keep track of how much inventory you have:

Description on Purchase Transactions. This is the description that you want to appear on the purchase orders you issue to purchase inventory items. Describe the product in terms that the vendor understands, because you can use a different description for the invoices that customers see.

Cost. Enter what you pay for one unit of the product. QuickBooks counts on your selling products in the same units that you buy them. For example, if you purchase four cases of merlot but sell wine by the bottle, enter the price you pay per bottle in this field.

COGS Account. Choose the account to which you want to post the costs when you sell the product. (COGS stands for cost of goods sold, which is an account for tracking the underlying costs of the things you sell in order to calculate your gross profit.)

Note

If you don’t have a cost of goods sold account in your Chart of Accounts, QuickBooks creates a Cost of Goods Sold account for you as soon as you type the name for your first inventory item in the New Item dialog box.

Preferred Vendor. If you choose a vendor in this drop-down list, QuickBooks selects the preferred vendor when you add this Inventory Part item to a purchase order.

Figure 4-7. When you open the Edit Item dialog box to inspect or alter an Inventory Part item, QuickBooks calculates several inventory statistics for that item. These statistics appear at the bottom of the dialog box. On Hand represents the quantity of the item available in inventory. Avg. Cost is the average cost you’ve paid for all the units you’ve purchased; QuickBooks uses the average cost when deducting the value of units sold from the inventory asset account. On P.O. is the number of units you have on purchase orders but have not yet received.

Description on Sales Transactions. When you type a description in the Description on Purchase Transactions box, QuickBooks copies that description into the Description on Sales Transactions box. If your customers wouldn’t recognize the description you use to buy the product, type a more customer-friendly description in this field.

Sales Price. In this field, type how much you charge for the product. Make sure that the Cost field uses the same units. For example, if you sell a bottle of merlot for $15, type 15 in this field and type the cost per bottle in the Cost field.

Tax Code. When you add an item to an invoice, QuickBooks checks this code to see whether the item is taxable. (QuickBooks comes with two tax codes set up: “Non” for nontaxable items and “Tax” for taxable items.) Most products are taxable, although groceries are the most familiar exception.

Income Account. Choose the income account from your Chart of Accounts to which you want to post the money you receive when you sell one of these products.

Asset Account. Choose the asset account to which you want to post the value of the inventory you buy. Suppose you buy 100 bottles of merlot, which are worth the $8-a-bottle you paid. QuickBooks posts $800 into your inventory asset account. When you sell a bottle, QuickBooks deducts $8 from the inventory asset account and adds that $8 to the cost of goods sold account.

Reorder Point. Type the quantity on hand that would prompt you to order more.

Tip

If you can receive products quickly, use a lower reorder point to reduce the money tied up in inventory and prevent write-offs due to obsolete inventory. Just-in-time delivery is popular for exactly these reasons. When products take some time to arrive, set the reorder point higher. Figuring out the right reorder point for each product requires time and experience. Start with your best guess and edit this field as business conditions change.

Non-inventory Part items play two important roles in QuickBooks. First, you’ll need Non-inventory Part items if you use purchase orders to buy supplies. The second role involves reselling products that you don’t keep in inventory. For example, suppose you’re a general contractor and you purchase materials for a job. When you use Non-inventory Part items, QuickBooks posts the cost of the products to an expense account and the income from selling the products to an income account. You don’t have to bother with the inventory asset account, because you transfer ownership of these products to the customer almost immediately. See page 195 to learn how to charge your customer for these reimbursable expenses.

The good news about Non-inventory Part items is that they use all the same fields as Service items. The bad news is the few subtle differences you need to know. Take the following disparities into account when you create Non-inventory Part items.

"This item is purchased for and sold to a specific customer:job” checkbox. The checkbox goes by a different name, but its behavior is the same. Turn on this checkbox when you want to use different values on purchase and sales transactions.

When you turn this checkbox on, QuickBooks displays an Income Account field and an Expense Account field, like the fields you see in the bottom figure of Figure 4-6. For Non-inventory Part items, the accounts that you choose are income and expense accounts specifically for products. Read the next bullet to find out what happens when you turn this checkbox off.

Account. If you don’t resell this product and you thus turn off the “This item is purchased for and sold to a specific customer:job” checkbox, you see only one Account field. If you create this item to buy company supplies using purchase orders, QuickBooks considers the account in this field as an expense account for the purchase.

Tax Code. The Tax Code field works exactly the same way as the Tax Code field for a Service item. Choose Non if the products are non-taxable, such as groceries. Choose Tax if the products are taxable.

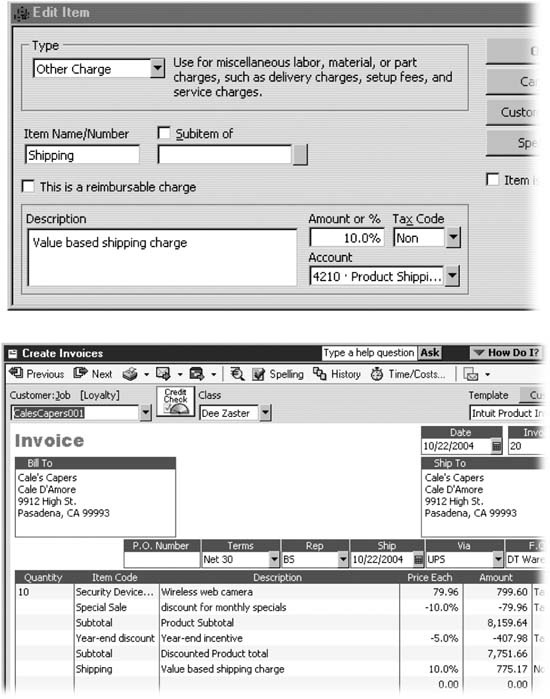

For Other Charge items, the checkbox for hiding or showing cost fields comes with the label “This is a reimbursable charge.” For example, turn on this checkbox when you want to set the Cost field to the actual Federal Express charge and the Sales Price to the shipping and handling fees you charge your customers. You’ll see the same sets of fields for purchases and sales as you do for Service and Non-inventory Part items.

Alternatively, you can create charges that don’t link directly to expenses by turning off the “This is a reimbursable charge” checkbox. You can create a percentage, which is useful for calculating shipping based on the value of the products being shipped, as demonstrated in Figure 4-8.

Figure 4-8. Top: To create a percentage-based charge, type a number followed by “%” in the “Amount or %” field. Bottom: When you add a percentage-based Other Charge item to an invoice, QuickBooks applies the percentage to the previous line in the invoice. If you want to apply the Other Charge percentage to several items, add a Subtotal item to the invoice before the Other Charge item.

You can also define a dollar value charge for a country club’s one-time initiation fee. When you turn off the “This is a reimbursable charge” checkbox, the Cost and Sales Price fields disappear, and the “Amount or %” field takes their place. If you want to create a dollar charge, type a whole or decimal number in this field.

You need only one Subtotal item, because every Subtotal item does the same thing—it totals all the amounts for the preceding lines up to the last subtotal. Because you can’t change a Subtotal item’s behavior in any way, a Subtotal item has just two fields: Item Name/Number and Description. You can type any name and description you wish in these fields, but in practically every case, Subtotal says it all.

A Group item can add several items to an invoice at once. For example, you can create a Group item, such as Landscaping, that contains the individual Service items for every phase of a construction project. When you add this Landscaping Group item to an invoice, QuickBooks adds the Service items for phases, such as Excavation, Grading, Planting, and Cleanup.

You can also use a Group item to hide the underlying items, which is mainly useful when you create fixed-price invoices (page 81) and you don’t want the customer to know how much profit you’re making. Here’s how you set up a Group item to do these things:

Figure 4-9. When you add a Group item to an invoice, QuickBooks fills in the Description cells for each individual item with the contents of its Description field. The background in the Description column is a different color to indicate that you can’t edit these cells.

Print items in group. To show all the underlying items on your invoice, turn on the “Print items in group” checkbox. Figure 4-2 on page 81 shows examples of both showing and hiding the items within a group.

Item. To add an item to a group, click a blank cell in the Item column and choose the item you want, as shown in Figure 4-9.

Description. Type a description of the group that gives a sense of the individual item within it, such as Landscaping Project.

Qty. When you create a Group item, you can include different quantities of items, just like a box of note cards usually includes a few more envelopes than cards. For each item, type how many you typically sell as a group. If the quantity of each item varies, type 0 in the Qty. cells. You can then specify the quantities on your invoices after you’ve added a Group item.

The Discount item deducts either a dollar amount or a percentage for discounts you apply at the time of a sale, such as volume discounts, damaged goods discounts, or the discount you apply because your customer has incriminating pictures of you.

Note

QuickBooks applies early payment discounts in the Receive Payments dialog box, so you don’t create Discount items for those.

The fields for a Discount item are similar to those of an Other Charge item with a few small differences—described here:

Amount or %. This field is always visible for a Discount item. To deduct a dollar amount, type a positive number (whole or decimal) in this field. To deduct a percentage, type a whole or decimal number followed by “%,” for instance, 5.5%.

Account. Choose the account to which you want to post the discounts you apply. You can post discounts to either income accounts or expense accounts.

When you post discounts to an income account, they appear as negative income, so your gross profit reflects what you actually earned after deducting discounts. Posting discounts to expense accounts, on the other hand, makes your income look better than it actually is. The discounts increase the amounts in your expense accounts, so your net profit is the same no matter which approach you use.

Tax Code. When you choose a taxable code in the Tax Code field, QuickBooks applies the discount before it calculates sales tax. For instance, if a customer buys products on sale, she pays sales tax on the sale price, not the original price.

When you choose a nontaxable code in the Tax Code field, QuickBooks applies the discount after it calculates sales tax. You might have a reason to do this, but understand that you’ll collect less sales tax from your customers than you must send to the tax agencies.

Beyond the Type, Item Name/Number, and Descriptions fields, the Payment item boasts fields unlike those for other items. These fields, shown in Figure 4-10, should look familiar if you’ve already set up customers in QuickBooks.

Figure 4-10. The fields for a Payment item designate the method of payment that a customer uses and whether you deposit the funds to a specific bank account or group them with other undeposited funds. For example, if your customers send checks, you save up the checks you receive each week and make one trip to deposit them in your bank. On the other hand, credit card payments transfer directly into a bank account.

Payment Method. Choose the payment method, such as cash, check, or brand of credit card. In the Make Deposits dialog box, you can filter pending deposits by the type of payment method.

Group with other undeposited funds. Choose this option if you want to add the payment to other payments you received. When you add the Payment item to a sales form, QuickBooks adds the payment to the list of undeposited funds. To actually complete the deposit of all your payments, choose Banking→Make Deposits.

Deposit To. If payments flow into an account without any action on your part, such as credit card or electronic payments, choose this option and then choose the bank account in the drop-down list.

Like the IRS, each tax agency wants to receive the taxes it’s due. To track the taxes you owe to each agency, create a Sales Tax Item for each agency. For example, if you sell products through direct mail, you’ll need a Sales Tax Item for each state with sales tax that you ship to. Here’s the pertinent information on Sales Tax Item fields:

Tax Name. Instead of an Item Name/Number label, the label for the name field is Tax Name. However, the name you enter appears in the Name column of the Item List, just like other types of items.

Tax Rate. When you create a Sales Tax Item, QuickBooks goes ahead and fills in the Tax Rate field with 0.0%. You can edit QuickBooks’ entry, but the easiest way to enter a rate is to double-click the field to select the entire entry, and then type the whole or decimal number for the percentage. For example, if you type 2.2, QuickBooks changes the field to 2.2%.

Tax Agency. This drop-down list displays the vendors you’ve created in your Vendor List. To make tax agencies easier to find, consider creating a top-level vendor (see page 104) for tax agencies and then creating subitems for each tax agency to which you pay taxes.

A Sales Tax Group item calculates the total sales tax for multiple Sales Tax Items—perfect when you sell goods in an area rich with state, city, and local sales taxes. The customer sees only the total sales tax, but QuickBooks tracks how much you owe to each agency. This item works in the same way as the Group item, except that you add Sales Tax Items to cells instead of items such as Service, Inventory, and Other Charges.

You can change information about an item even if you’ve already used the item in transactions. The changes you make don’t affect existing transactions. When you create new transactions using the item, QuickBooks uses the current information to fill in fields.

Note

If your company owns multiple copies of QuickBooks Pro, Premier, or Enterprise, no one else can access the QuickBooks file while you’re editing items. To switch QuickBooks to single-user mode so you can edit items, ask others to exit QuickBooks. When everyone has logged off, choose File→Switch to Single-User Mode. After you finish editing your items, choose File→Switch to Multi-User Mode and notify your colleagues that they can log into QuickBooks again.

To modify an item, open the Item List window by choosing Lists→Item List, and then double-click the item that you want to edit. QuickBooks opens the Edit Item window. Make the changes you want and click OK when you’re done.

Be particularly attentive if you decide to change the Type field. You can change only Non-inventory Part or Other Charge items to other item types. You can change them to Service, Non-inventory Part, Other Charge, Inventory Part, or Inventory Assembly item types (this last type is available only in QuickBooks Premier and Enterprise). If you conclude from this that you can’t change a Non-inventory Part item back once you change it to an Inventory part, you’re absolutely correct. To prevent type change disasters, back up your QuickBooks file before switching item types (see page 160).

Note

On page 80 you learned that parts that you keep in inventory have value that shows up as an asset of your company. Non-inventory parts show up simply as expenses. If you change an item from a Non-inventory Part to an Inventory Part, be sure to choose a date in the As Of field that is after the date of the last transaction that uses the item in its Non-inventory Part guise.

Deleting items and hiding them are two totally different actions, although the end result is the same—QuickBooks doesn’t display the items in the Item List window. The only time you’ll delete an item is when you create it by mistake and want to eliminate it permanently from the Item List. As you might discover when you attempt to delete an item, the only time you can delete one is if you have never used it in a transaction.

Hiding items doesn’t have the same restrictions and offers a couple of advantages to boot. First, when you hide items, they don’t appear in your Item List, which prevents you from selecting the wrong item as you create an invoice or other sales form. Unlike deleting, hiding is reversible. You can switch items to active status if you start selling them again. Suppose you hid the item for bell bottom hip huggers in 1974. Decades later, when 70s retro becomes cool again, you can reactivate the item and use it on sales forms. Of course, you’ll probably want to edit the cost and sales price to reflect today’s higher prices.

When you’ve sold an item in the past, the only way to remove it from the Item List is to hide it. Hiding items means that your Item List shows only the items you currently use. You’ll scroll less to find the items you want and you’re less likely to pick the wrong item by mistake. If you start to sell an item again, you can reactivate it so that it appears on the Item List once more. If you’re wondering how you make an item reappear if it isn’t visible, here’s a guide to hiding and reactivating items in your Item List:

Hide an item. In the Item List, right-click the item and choose Make Item Inactive from the shortcut menu. The item disappears from the Item List.

View all items, active or inactive. At the bottom of the Item List window, turn on the “Include inactive” checkbox. QuickBooks displays a column with an X as its heading and displays an X in that column for every inactive item in the list. The “Include inactive” checkbox is grayed out when all the items are active.

Reactivate an item. First, turn on the “Include inactive” checkbox to display all items. To reactivate the item, click the X next to its name. When you click the X next to a parent item, QuickBooks opens the Activate Group dialog box. If you want to reactivate all the subitems as well as the parent, click Yes.

Tip

If you find that you’re constantly hiding items that you no longer sell, your item list might be too specific for your constantly changing product list. For example, if you create a hundred items for the clothes that are in with teenagers in May, those items will be obsolete by June. Consider creating more generic items, such as pants, shorts, t-shirts, and bathing suits. You can reuse these items season after season, year after year without worrying about running out of room on the Item List, which is limited to 14,500 items. (To see how many items you have, press F2 to open the Product Information window and then head to the List Information section.)

If you improperly create an item and catch your mistake immediately, deleting the offender is no sweat. Use any one of these methods to delete an item:

In the Item List window, select the item you want to delete and press Ctrl+D.

If commands on menus are more to your liking, in the Item List, select the item, and then choose Edit→Delete Item.

In the menu at the bottom of the window, click Item and then choose Delete.

If you try to delete an item used in even one transaction, QuickBooks warns you that you can’t delete the item. For example, you created an item by mistake and then compounded the problem by inadvertently adding the item to an invoice. When you realize your error and try to delete the item, QuickBooks refuses to oblige. If you used the item in one or two recent transactions, you can probably find those transactions and replace the item without thinking too hard. When you’ve removed the item from all transactions, use one of the methods above to delete it.

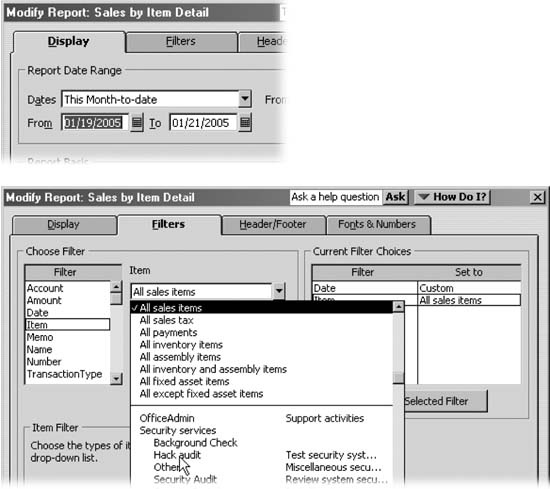

If you used the item in numerous transactions, it’s easier to find the transactions with the Sales by Item Detail report, which includes a heading for each item you sell, and groups transactions underneath each heading. If you sell lots of items, you probably want the report to show the transactions only for the item you want to delete. Here’s how you modify the Sales By Item Detail report and then edit the transactions:

To create a Sales By Item Detail report, choose Reports→Sales→Sales By Item Detail.

QuickBooks opens the Sales By Item Detail report in its own window.

To modify the report, in the button bar at the top of the Sales by Item Detail window, click Modify Report.

QuickBooks opens the Modify Report: Sales By Item Detail dialog box. To produce a report with transactions for one item, modify the date range and filter the report based on the item name, as demonstrated in Figure 4-11.

To edit a transaction to remove an item, in the Sales By Item Detail window, double-click the transaction.

Based on the type of transaction you double-click, QuickBooks opens the corresponding dialog box. For example, if you double-click an invoice, QuickBooks opens the Create Invoices dialog box and displays the invoice you chose.

In the Item Code column, click the cell that contains the item you want to delete, click the downward-pointing arrow in the cell, and then choose the correct item from the Item drop-down list.

To save the transaction with the revised item, click Save & Close.

You’ll know that you’ve successfully eliminated the item from all sales transactions when the report in the Sales By Item Detail window shows no transactions.

Tip

To be sure that you have removed all links to the item, in the menu bar at the top of the report window, click Refresh to update the report based on the current data in your QuickBooks file.

Figure 4-11. Top: If you know when you first used the item in a transaction, type or click that date in the From box. QuickBooks sets the date in the To box to the current date, which is perfect for this situation. Alternatively, in the Dates drop-down list, choose a pre-defined date range, such as This Fiscal Year-to-Date. Bottom: To filter the report by the item name, click the Filters tab. On the Filters tab, in the Filter list, choose Item. In the Item drop-down list, click the downward-pointing arrow and then select the item you want to delete. QuickBooks displays the modifications to the report in the Current Filter Choices section. Give these settings the once-over and if they look correct, click OK to revise the report.

To close the report window, in the upper right corner of the window, click the Close box.

Finally, back in the Item List window, select the item you want to delete and press Ctrl+D. In the Delete Item message box, click Yes to confirm the deletion of the item.

Get QuickBooks 2005: The Missing Manual now with the O’Reilly learning platform.

O’Reilly members experience books, live events, courses curated by job role, and more from O’Reilly and nearly 200 top publishers.